Disruption is more ripe in the call center space than any other corner of the services industry, and $1.6bn provider SYKES just upped the ante to feverish levels by becoming only the second-ever service provider to acquire deep RPA and intelligent automation expertise, since Accenture picked up Genfour 18 months ago. And $70m cash is a not insignificant sum to invest in consultative talent in this fast-emerging space in desperate need of experience and scale.

More significantly, Accenture is not a call center provider, SYKES actually is one – and now has the unique capability of attacking the market with automation-led customer experience engagements. While the market recently cogitated on the impacts of Concentrix/Convergys and Teleperformance/Intelenet, neither of these mergers had a genuine focus on intelligent automation (IA). And our new global study on AI covering 590 Global 2000 firms worldwide (conducted with KPMG), clearly shows intelligent automation is in unique demand across IT and customer service areas more than any organizational function:

So why is SYKES acquiring Symphony meaningful?

None of the “traditional” call center providers have upped the ante with automation. Until now. We have found this bizarre, as there are so many opportunities to improve broken processes, speed up customer response capabilities with both Robotic Process Automation (RPA) and Robotic Desktop Automation (RDA). There’s no surprise many of the Indian-heritage providers are jumping back into call center, sensing an easy opportunity to take business from vulnerable traditional call center providers with a disruptive automation-centric approach.

SYKES is not beset by legacy enterprise deals choking the life out of it. Call center providers that got too beholden to legacy clients with dinosaur FTE pricing models are really struggling. This was one of the prime reasons Convergys (despite being one of the industry’s finest purveyors of customer care) struggled to maintain market growth and ended up being acquired for an extremely attractive price by Concentrix earlier this year. SYKES is currently the 7th largest player in the contact center space (3% market share) with revenues of $1.7bn – enough to compete at the high-end, but still nimble enough to build a base of automation-led clients, chase strategic deals and be a disruptive nuisance in a market with razor-thin profit margins.

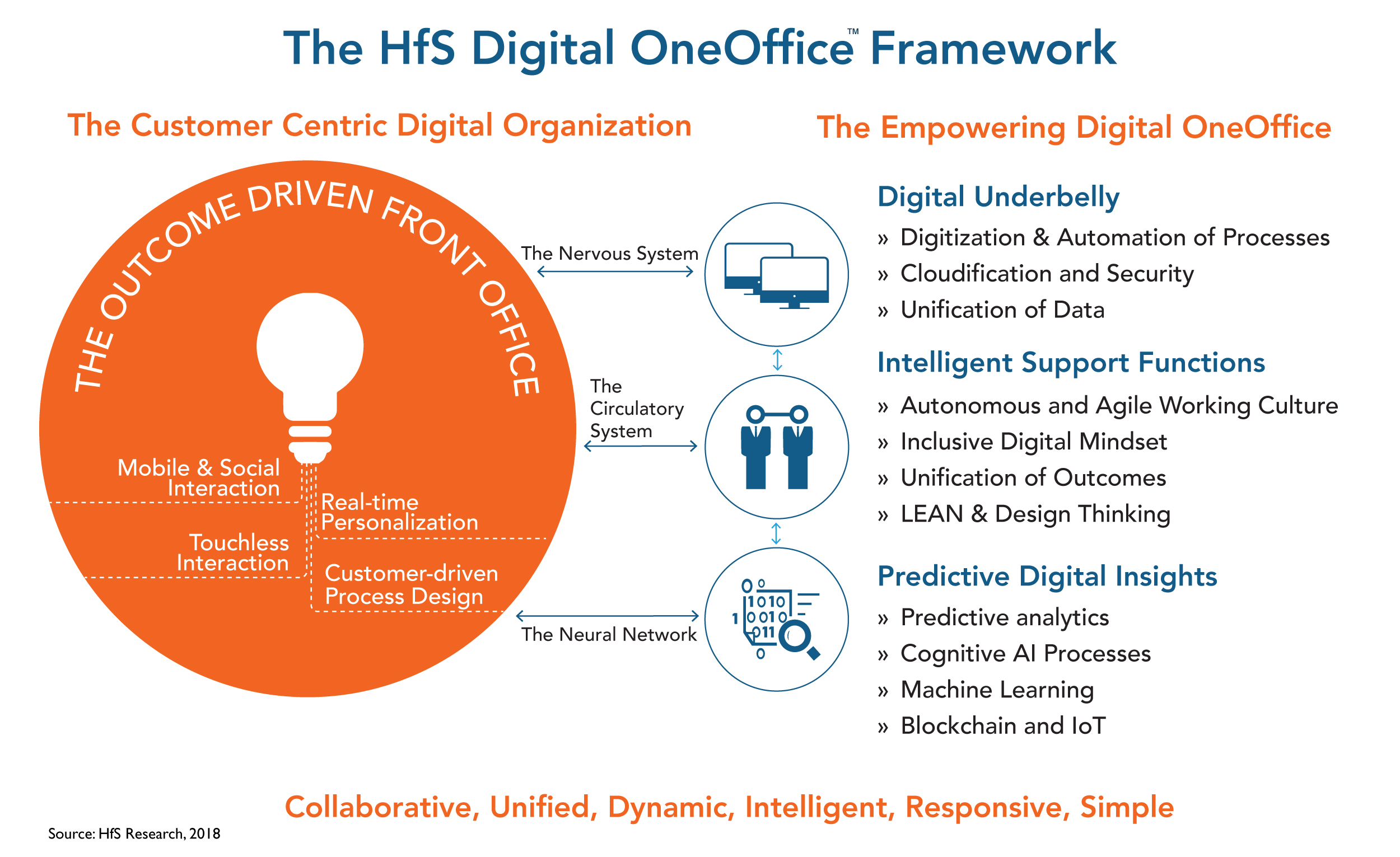

The OneOffice is here and Symphony can link the front to back office with its approach to digital operations. Digital organizations must have an operating framework that maps out how they have to operate in the future. Traditional operating models, while creating some incremental productivity value, if managed effectively, struggle to drive the unification of digital business models with emerging technologies across a business’s operations. The only true way to create a OneOffice experience is to be able to integrate the front office processes and interactive technologies (most of which are embedded in the call center) with the operations of the organization:

The Digital OneOffice is where teams function autonomously across front, middle and back office functions to promote broader processes with real-time data flows that support rapid decision making. It’s where front, middle and back offices will cease to exist, as they will be, simply, OneOffice. SYKES has a unique opportunity to consult to enterprises to make these front to back connections and weaves these capabilities into their managed services offerings. The merged entity can offer real expertise to provide automated processes as-a-service and help their clients through the journey. The only missing pieces, in the short-medium term, may be to diversify further into the middle office areas and analytics to add some real end-to-end process value, but much of this can also be accomplished through some smart partnerships.

SYKES has already been making serious investments in digital capability. The Clearlink acquisition gave SYKES capabilities in the digital marketing space, which is complementary to its core business and also a differentiator from its peers in the contact center world. SYKES’ strategy here is to connect across the customer lifecycle for an “omnichannel” solution— really digital CX. Qelp is another acquisition that expanded SYKES’ value proposition outside of core contact center services — a call center software firm specializing in self service on mobile phones, a real boon for its telecom clients.

SYKES has a sizeable WAHA delivery workforce (acquired through Alpine Access in 2012) which is a particular strength for its retail clients. The scalability and virtual training of this program is particularly effective. OneSYKES, its cloud delivery and WFM platform enable this capability. The platform also enables customer interaction analytics.

SYKES’ strength in the retail and telecom businesses. These are two of the most prime industries for automation-centric offerings, and where demand is very high (see earlier post on vertical focus in RPA). Added focus in the financial services sector would also be beneficial post-merger.

What does a SYKES/Symphony really bring to the table?

One of the last remaining automation services independents with credible global scale. With Genfour long out of the picture (and submerged somewhere inside Accenture) there are very few independent automation consultancies left worth evaluating that can impact a business the size of SYKES. Sure, there are some boutiques, such as Virtual Operations, Mindfields and Roboyo, that add some domain expertise, but nothing close to the scale of Symphony, which has 200 FTEs across Europe, North America, India and Mexico. It will be hard for any of SYKES’ competitors to respond in kind, and we are quite amazed that only one of them had made a serious move to acquire Symphony prior to SYKES’ interest.

Skill+Scale. Enterprise clients want the skill of the small guys (but not the risk), the scale of the big guys (but not the baggage). This sends out a shot across the bow to the likes of Accenture, Capgemini, Cognizant, Deloitte, EY, Genpact, KPMG etc., all competing in the quasi-consultative / managed service market… that is automation-led capability.

Appeals to the RPA software firms. The likes of Automation Anywhere, Blue Prism and UiPath will welcome any deal like that that takes them more into the front office of enterprises. This will also attract the attention of Nice, which has a strong call center automation focus. Other aspirational RPA firms, such as Pega, WorkFusion and Kofax, will also take notice and want to engage with this new entity.

Streetwise expertise. The four founders all bring a “hands-on” credibility to the table, which most organizations like to deal with: David Poole, Ian Barkin, David Brain and Pascal Baker. Many enterprises are already frustrated dealing with some of the usual suspects and may be tempted to switch to this new entity to take its OneOffice play to a new level. Obviously, much depends on SYKES leadership’s ability to retain the Symphony talent and engage them with a compelling global story.

Hands the Symphony team significant enterprise access. This will catalyze growth and disruption by giving Symphony access to a unique portfolio of 200+ enterprise clients including more than 50% of the world’s top 100 brands. While the Big 4 RPA experts struggle to convince their global partner colleagues to let them near their deep-pocketed clients, SYKES should have no problem opening the kimono to its finest differentiator that none of its competitors can (currently) boast.

Can start to heal the ‘scale disease’ threatening to derail the RPA and Intelligent Automation industry. As our (soon-to-be-unveiled) global study of 590 leaders of Intelligent Automation initiatives reveals, barely more than one-in-ten enterprises has reached a place of industrialized scale with RPA – and the word from so many clients is loud and clear that they need help:

This struggle to get to a point beyond pilot exercises and project-based experimentation could prove to be a serious point of failure for the whole industry drivthese solutions. There needs to be a much stronger melding of enterprises with implementation and consulting capability to fix these issues. This has to be an area where a SYKES/Symphony can profit.

The Bottom-line: Kudos to SYKES for making a bold bet, which has real potential. But it needs to move fast and aggressively post-acquisition to make this bear fruit

If I had to count the number of truly successful services / consulting mergers over the past decade, it wouldn’t take me very long, or require too many fingers. In so many cases, the acquiring firm is checking a box before moving onto the next shiny new object. What excites me about this move is the size of SYKES to make this really significant for the firm, the fact Symphony gives it a capability truly differentiating and hard for its competitors to replicate, and the fact it becomes the first customer-centric service provider to tackle the unquenched thirst for automation across customer processes to drive genuine OneOffice endstates.

But this is a market that simply refuses to stand still… this has to be a merger that both parties fully embrace with the verve and energy that took Symphony from a great idea in 2013 to one of the most disruptive and exciting consulting businesses in the business operations industry. That means SYKES needs to do a much better job of articulating to the world what it brings to the table, especially in the cut-throat world of customer experience BPO. SYKES leadership needs to make Symphony front and center and refuse to blunt its edge in driving narrative – staying ahead of the curve and forging great industry relationships.

In addition, SYKES needs to add to the OneOffice capability, search the globe for expertise in regions such as China, Philippines, Japan,South America and Canada. This can be with further tuck-in acquisitions and smart organic talent acquisition. It will also need to work extremely hard defining its brand and articulating the new generation of OneOffice solutions to industry. This is an exciting merger, but the hard work really starts now…

Posted in : OneOffice, Robotic Process Automation

Congratulations to Symphony Ventures and SYKES. It is wonderful to see this success in RPA services. The journey continues, and with these advancements, the future of the space is bright.

Fantastic piece Phil – well written and you articulate the value of RPA in the contact center well. Surprised the price was so high for a 200 FTE firm – why the uplift for a consulting business where valuations are rarely 1x revenues?

James

Call Centre and Automation are a bit of an oxymoron.

@Theo: not if you can stitch together all the manual crap to make the whole CX experience function digitally – is more simple than many people realize when you get down and dirty into the legacy tech and manual workarounds. The rubbish I hear about “80% of the call center is automatable”… then why does Amazon have 95 of them around the world. RPA is a gateway for getting this started, before higher value solutions, such as cognitive assistants can be much more effective. The trick is to digitize the science and invest in the art… where the talented call center rep adds most value. PF

Phil, Melissa, very insightful read – fantastic article. Thank you for sharing it.

@James – Symphony was in the unique position of being the only pure play with enough global scale and enterprise relationships to add immediate capability to the SYKES model. In addition, there were several other providers and consultants all keen to make the move. Sure, SYKES paid a handsome price, but if this positions the firm as the leader in call center automation and a real OneOffice thought leader, then $70m is a drop in the Ocean. I recall ISG paid $74m for Alsbridge in an attempt to tie up outsourcing advisory, where there was huge overlap in clients. SYKES/Symphony is entirely complimentary and all new revenue is addititive. If Symphony drives, say, $40m next year and $75 the following, they have likely already paid off their proce tag. Not to mention the value they bring to SYKES winning call center deals from ambitious clients, and the overall value of SYKES in the market,

PF