This week has marked a pivotal occasion in HfS’ development as a research analyst organization, with our official launch of the HfS BPO PriceIndicator™. As a special thank you for all your support, we are making our flagship 2011 F&A BPO market landcape report available as freemium for our subscribers – but only for one week! So download your copy today. Oh – here’s the exec summary:

Re-emerging from the Recession, re-focusing on business outcomes

HfS believes the market for finance and accounting business process outsourcing (F&A BPO) services is poised for a new phase of growth, as businesses recover from the Recession and focus on new strategies to drive more efficient operations in an increasingly global economy. F&A BPO fits the bill for an increasing number of organizations, while some still prefer to maintain their finance and accounting operations in-house.

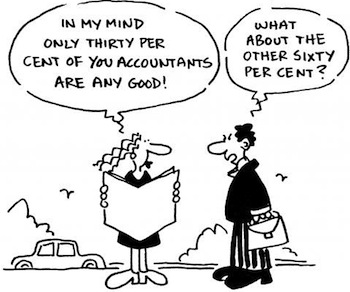

Outsourcing the number-crunchers… are you ready?

However, one thing is certain – once a company makes the decision to outsource F&A processes, it will be committed to working with a service provider for many years, if not decades, hence, getting this right is going to have a major impact on its culture and operational performance over the long-haul.

This report delivers an unprecedented view of the F&A BPO industry, based on 788 live engagements, where organizations have outsourced two or more core F&A processes to a service provider. In addition to exhaustive contract information, HfS draws upon recent demand-side survey analysis to deliver the complete view of the market dynamics, the service provider landscape and the future expected direction of the industry. Key findings are summarized as follows:

» Untapped market. The market for F&A BPO is largely untapped moving into 2011, with fewer than 800 live engagements and only one-in-six enterprises outsourcing transactional accounting activities to a third party service provider.

» Recovering economy rekindles outsourcing motives. While the F&A BPO market grew rapidly between 2004 and 2008, interest cooled during the Recession as enterprises focused on shorter-term survival measures and put disruptive initiatives, such as BPO, on the backburner. However, with recovery under way, many businesses are refocusing attention on global outsourcing opportunities as a means, not only to reduce operating cost, but also to provide an impetus to globalize operations and transform processes. Consequently, 13% of enterprises are now intending to move into an F&A BPO model over the next year, with strong motivation coming from mid-market organizations ($750m – $3bn revenues).

» Availability of smaller engagement models drives sustainable growth. With engagement sizes falling below $20m total contract value for the first time, and service providers developing more “repeatable” delivery models that can be provisioned across multiple clients, HfS expects 15% annual growth in total F&A BPO expenditure over the next two-to-three years.

» Gainshare incentives becoming an integral component of F&A BPO engagements. With close to 50% of recent engagements involving gainshare (outcome-based) incentives, the aggressive competitive climate will provide attractive opportunities for many enterprises evaluating their first steps into F&A BPO, in addition to experienced buyers seeking more value from their current model. Moreover, gainshare initiatives can provide the differentiation between providers, as opposed to simply low-cost provision, which HfS views as a major step forward in taking F&A BPO value beyond short-term labor-arbitrage savings for clients.

» The competitive landscape takes shape with four clear market leaders. The global F&A BPO market is dominated by Accenture and IBM, with both Capgemini and Genpact providing the major competition for large-scale engagements. However, aggressive competition is expected from a host of other providers eager to secure a stronger market presence, including multi-billion dollar offshore-centric service providers Infosys, TCS and Wipro, in addition to BPO pure-play specialists EXL Service and WNS. Other providers with strong BPO businesses include Xerox and HP, but they have not proven to be as aggressive in the marketplace since recent mergers with ACS and EDS respectively. HfS expects further consolidation in the competitive environment.

» IT-enablement of BPO becoming pivotal to development of services. HfS anticipates increased hybrid IT-BPO engagements where service providers provide application wrappers to enhance process standardization for buyers. More than over half of today’s buyers are now enhancing or replacing their existing finance IT systems with their BPO engagement. However, HfS Research shows that adoption of Cloud computing with finance applications is still some way off for most high-end enterprises.

HfS Research’s new report entitled “The F&A BPO Market Landscape in 2011: Re-emerging from the Recession, Re-focusing on Business Outcomes” is authored by HfS Research’s Founder and CEO Phil Fersht. You can download your freemium copy at our research site.

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, Finance and Accounting, Procurement and Supply Chain, Sourcing Best Practises

[…] The Finance & Accounting BPO market landscape in 2011 […]

[…] HfS Research’s new report entitled “The F&A BPO Market Landscape in 2011: Re-emerging from the Recession, Re-focusing on Business Outcomes” is authored by HfS Research’s Founder and CEO Phil Fersht. You can download your freemium copy at our research site. (Cross-posted @ Horses for Sources) […]

Phil,

Thank for you making such a comprehensive – and superb – report available to industry. You are a credit to your profession and deserve the recognition you and your new firm is quickly getting,

Martin Buckley

Shucks, Martin! We aim to please 🙂

[…] is the original post: The Finance & Accounting BPO market landscape in 2011 Comments […]

[…] The Finance & Accounting BPO market landscape in 2011 […]

[…] BPO) providers, and both recently touted as acquisition candidates in HfS Research’s 2011 F&A BPO market landscape, have tied the knot in a surprising merger, in this rapidly-consolidating and transmutating BPO […]

[…] Technology), and Salvino. Take a leading ERP system integrator, mix it with a BPO powerhouse (see our FAO report), and sprinkle on 16,000 management consultants and, at least in Accenture’s perspective, […]

[…] Technology), and Salvino. Take a leading ERP system integrator, mix it with a BPO powerhouse (see our FAO report), and sprinkle on 16,000 management consultants and, at least in Accenture’s perspective, their […]

[…] Technology), and Salvino. Take a leading ERP system integrator, mix it with a BPO powerhouse (see our FAO report), and sprinkle on 16,000 management consultants and, at least in Accenture’s perspective, their […]

[…] & Accounting BPO: As we discussed during our recent F&A market analysis, F&A BPO has emerged aggressively after being back-burnered considerably during the Recession. […]

[…] The Finance & Accounting BPO market landscape in 2011 […]

[…] The Finance & Accounting BPO market landscape in 2011 […]

[…] The Finance & Accounting BPO market landscape in 2011 – As a special thank you for all your support, we are making our flagship 2011 F&A BPO market landcape report … market landscape in 2011: Re-emerging from the Recession, re-focusing on business outcomes HfS believes the market for finance and … […]

[…] The Finance & Accounting BPO market landscape in 2011 – So download your copy today. Oh – here’s the exec summary: The F&A BPO market landscape in 2011: Re-emerging from the Recession, re-focusing on business outcomes HfS believes the market for finance and accounting … as opposed to simply … […]

[…] The Finance & Accounting BPO market landscape in 2011 – As a special thank you for all your support, we are making our flagship 2011 F&A BPO market landcape report available as freemium … outcomes HfS believes the market for finance and accounting business process outsourcing (F&A BPO) services is … […]