New research from HfS clearly shows all is not as it seems in the global services landscape. HfS’ Jamie Snowdon investigates…

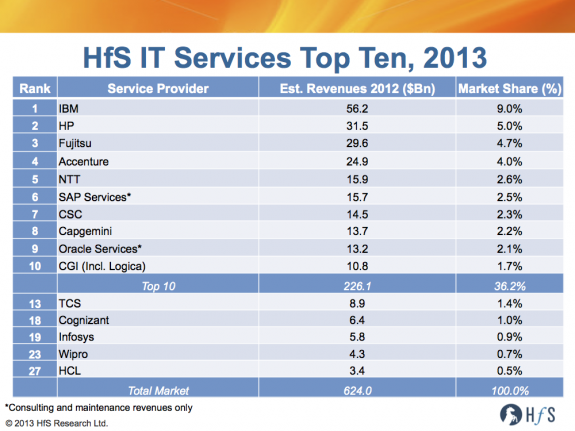

It would be easy to forgive anyone for assuming that the Indian services majors Wipro, Infosys, TCS, Cognizant and HCL (aka the “WITCH” providers) are dominating the global battle for services supremacy, given the hype that surrounds India’s dynamic IT outsourcing economy. However, In spite of their impressive growth over the past ten years, none of the WITCH providers have yet to make the HfS Top 10 of global IT services firms, despite dominating the application development and management business:

The first of the WITCH providers likely to break the Top 10 is TCS, provided it can maintain its current growth trajectory, break through its landmark $10bn revenue barrier, and there aren’t major acquisitions or merger amongst the Top 20 providers.

The IT services competitive landscape is still dominated by the traditional large global IT firms (HP, IBM, Accenture), the global enterprise software companies and local IT services firms with strong domestic/regional market positions (Fujitsu, NTT, Capgemini, CSC, CGI).

HfS Research’s new Global IT Services Market Size and Forecast 2013 provides an analysis of the recent financial performance of the leading IT Services companies and the key drivers and inhibitors that are driving growth in these markets, particularly how they are coping with the endlessly on-going economic crisis in Europe and the key technology and business dynamics driving growth in 2013 and beyond.

Ten ways the WITCH providers can break the IT Services Top Ten

1. Develop a greater client base outside of the US – particularly continental Europe where the benefits of offshore development are beginning to be recognized

2. Move up the value chain – too many of them are being “ring-fenced” into the IT back office and struggling to get a bigger chunk of the integration business

3. Expand into the upper-middle market ($1-$5bn revs), where the heritage western firms are much less dominant and demand is highest

4. Acquire more consultative capability to move clients into the cloud

5. Invest in word class BPO and business transformation capabilities to become genuine “technology enablers” and not solely IT body shops

6. Focus on verticals where they can really differentiate with institutional expertise and stop trying to be “all things to all people”

7. Become more global in nature, establishing more middle and upper management in locations outside of India

8. Diversify more aggressively IT infrastructure-based services and become less reliant on lower-level ADM work

9. Diversify beyond legacy ERP services into supporting SaaS enviroments such as Salesforce.com, Workday, Netsuite etc.

10. Acquire a “traditional” onshore IT services business that can add many of the areas mentioned in points 1-9

Posted in : Cloud Computing, Confusing Outsourcing Information, HfSResearch.com Homepage, IT Outsourcing / IT Services

Indian IT companies also need to remember to hire horses..once hired give them food like horses not like goats which Indian IT companies generally do to exploit the full capabilities of the horse

A very insightful and useful post. It’s clear that the Indian firms need to take two routes to break this:

1) Become more global and invest in more local resources to support business, especially in areas like infrastructure services. This is why visa reform could really help these firms, but forcing them to “glocalize” their workforces.

2) Become more consultative. Currently they are really just trying to get their clients to “hand over” various elements of their IT delivery (mainly low-end), as opposed to more collaborative relationships where they are working closely with their clients to do more strategic work. Eventually, this type of commodity IT work will dry up leaving the Indian firms under massive pressure to maintain their growth and their margins.

Both these areas require investment in people and capability – much of it outside of India,

Jack

TCS FY 2012 – 13 revenue was $ 11.6 Bn USD. That makes it race into the Top 10 if I am not wrong (FY 2013 – till March 2013). To maintain sustainable growth Indian IT companies need to sweat a lot in future. International visa reforms, reduction of other entry barriers in different countries / customers, positive mind shift of customers to Indian IT service providers from traditional IBM and Accenture outsourced contracts to unlock value potential and improving productivity within the organization by Indian IT providers will help them to grow more. One get shivers looking at Witches ! Does this hold good for the current top 10 too? Are they afraid of Indian IT Service Providers’ growth trends?

! Does this hold good for the current top 10 too? Are they afraid of Indian IT Service Providers’ growth trends?

Thanks for the feedback.

Abhishek and Jack – to break into the Top 10 quickly there needs to be investment in more onshore services from these firms – we are seeing greater investment in Continental Europe – with many of the WITCH firms making consulting acquisitions, hiring experienced local country managers and starting some onshore graduate programs but these are still relatively small compared to IBM/Accenture. It is just a matter of scale.

Senthil – Just to clarify the revenues we published are just IT services – so we don’t include BPO or software/hardware products within these figures. Also they are adjusted to calendar year. So TCS still has a little way to go. I expect that TCS will make it in 2014 – but it could be earlier if makes a sizable acquisition. The main reaction from the current top 10 (and many of the smaller onshore firms) has been to expand offshore capabilities and focus on demonstrating value.

Jamie

As always, great insights.

Have you thought about comparing the management styles and inner circle decision-making of the Japanese ? The Japanese were potentially dominant in tech in many sectors in the 1980’s but stayed with local culture in management. Your comments on what it means to be global are underscored by such a comparison,

Bill Bierce

Hi Bill,

The comparison with the Japanese firms is really interesting. They grew from sales within their domestic markets and largely it is still their domestic markets that makes them such large global players – including the two big players NTT and Fujitsu we have in our list. The WITCH companies are almost entirely opposite in terms of revenue – with most of their revenue from US/Europe and relatively (but becoming more important over time) modest domestic sales.

I suppose the Japanese tech firms international expansion was either driven by products initially or through acquisitions – an indication that the Japanese firms felt it was necessary to provide services locally. The WITCH companies again have sold services directly and have not made many major acquisitions relatively speaking. Perhaps the most interesting part of the comparison is the relative failure of the big Japanese firms international acquisitions. Although timing is an important factor here, the Japanese tech expansion was really through excellence of product design and production innovation rather than so much on cost during the 70s/80s. Labor arbitrage was not a factor!

Jamie

[…] the growth trajectory is now declining at such a clip that none of these providers may make the HfS IT Services Top Ten if they continue with their current growth […]

[…] we predicted last year, TCS has now become the first of the Indian majors to break the IT Services Top 10 for revenues, […]