It’s been a few weeks now since the surprise announcement of Accenture’s purchase of Procurian and, while the teams on both sides are busy working through details of the post-merger acquisition, we wanted to spend some time thinking about the implications of this deal for the other service providers in the Procurement Outsourcing (PO) market. What can they do in this short window, while the dust settles, to respond? Charles Sutherland pokes around at the post-Procurian procurement planet…

It’s been a few weeks now since the surprise announcement of Accenture’s purchase of Procurian and, while the teams on both sides are busy working through details of the post-merger acquisition, we wanted to spend some time thinking about the implications of this deal for the other service providers in the Procurement Outsourcing (PO) market. What can they do in this short window, while the dust settles, to respond? Charles Sutherland pokes around at the post-Procurian procurement planet…

Regardless of whether this purchase is positive, polysemous or problematic for a service provider, everyone has to recognize that the market landscape has shifted quite seismically in recent weeks, with a clear market leader emerging, in terms of market share, industry breadth and client footprint.

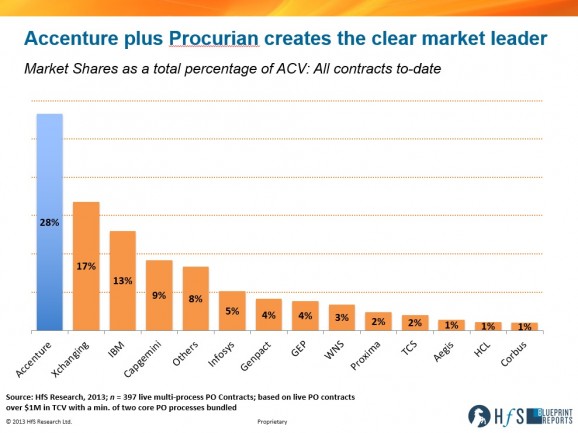

Using the market shares from our recent Procurement Outsourcing Blueprint we place the combined Accenture/Procurian at 28%, which is more than 1200 basis points greater than #2, Xchanging:

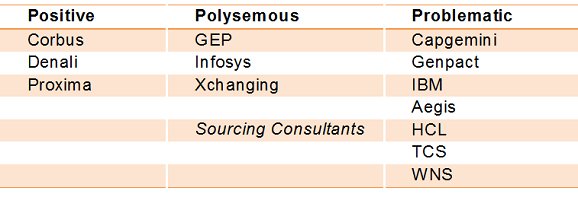

When we look at the remaining service providers, we see this acquisition in placing each one into the following these clusters: either positive, problematic or polysemous for the business, depending on the context and the opportunity. (We just couldn’t quite give up totally on the P alliteration but promise to stop now.)

The Positive Providers

So, why could the merger of two major competitors create a positive event for a PO service provider? Well, one of the key drivers for Accenture in buying Procurian was to expand its bench of seasoned category managers and sourcing experts – especially in direct materials. For all three of these specialists listed above, mid-sized providers which also have a depth in sourcing direct materials and category management (as well as consulting and transaction capabilities), are all now serious alternatives for buyers who may not want to go with Accenture. Moreover, they are also acquisition candidates for the service providers which now need to expand their own capabilities in response (e.g. most of the Problematic category).

The Polysemous Providers

For our polysemous service providers it’s a mix of positives and problems, as a result of this deal (and if you didn’t take Latin at school, Polysemous = multiple implications, in this context). GEP is another likely acquisition candidate for the Problematic providers, although the firm has been working hard to position itself as a technology, not sourcing-led, company and so they might not be first on the shopping list. The firm may find that ir has to make decisions as to where to invest if the market begins to place a greater emphasis on sourcing depth over technology in the near-term. Infosys and Xchanging are in similar positions, they have some depth in sourcing and some unique vertical strengths, but they won’t have the depth of an Accenture or an IBM in category management. What they do have going, is a greater use of proprietary technology than most PO service providers, and so steering buyers towards the value created by technology-led solutions is where the opportunity has emerged for both.

We also believe that this deal is a mixed blessing for the more traditional sourcing consultants. On one hand they now face reduced competition as Accenture’s own sourcing consulting practice will be part of the PMI plan for this acquisition and may emerge quite differently than it has been previously structured. It’s also positive in the sense that the smaller independent consultancies may be acquired by the Problematic positioned providers as readily as the likes of a Corbus, Denali or Proxima. But things aren’t all rosy; the core consulting business model in sourcing is under threat from the end-to-end capabilities of PO service providers, especially now with the depth of category management sitting in the leading companies. Also, for those PO service providers which don’t have the appetite (or cash) to make a sourcing acquisition, the consultants, managers and Partners of these consultancies make for very attractive focused hires to build up practices on a person-by-person or client industry-by-industry basis.

The Problematic Providers

This deal is problematic for other PO service providers whose depth and breadth in sourcing specialists and category managers, especially in key products or industry specializations, now clearly stand out as a competitive weakness versus Accenture.

For Capgemini and Genpact, this acquisition removes an established and growing alliance partner from their own solutions so they will need to invest in category management either through acquisition or hiring / organic growth.

For the smaller PO service providers including Aegis, HCL, TCS and WNS who generally entered the market with or from F&A P2P contracts, they need to decide if this is a sustainable strategy or whether they also need to follow in the footsteps of the larger diversified providers and quickly build up sourcing and category management benches. The alternative is to concentrate more on the transactional processing elements of PO and build their own technology platforms in the way that Infosys, GEP and Xchanging have been going.

Finally, for IBM, its strengths especially in manufacturing and consumer goods client industries for sourcing and category management are now matched by Accenture’s breadth and client references, and so the head-to-head competition that has marked this part of the market for the last several years has now become even more intense.

The Bottom-line: A spate of M&A has to emerge to re-balance the competitive nature of procurement outsourcing

Overall, it would come as no surprise to HfS to see a domino effect of acquisitions begin to take shape in Q1 of 2014 as the PO marketplace realigns itself to the post-Procurian world. We really do not expect their aggressive competitors simply to rollover and have their bellies tickled. IBM has laid out its master plan that Supply Chain Management is one of its core areas of growth and future investment; Infosys has gone gangbusters making the Pocurement Outsourcing Winner’s Circle after barely a few short years in the space; Capgemini has invested heavily in procurement with its acquisition of IBX and its fledgling supply chain BPO business and needs a strong procurement capability to balance its powerful F&A business; Genpact needs to expand its procurement strength and depth to compliment its F&A prowess. Accenture has forced the issue by sweeping up Procurian, now its competitors have to respond.

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, Cloud Computing, Finance and Accounting, HfSResearch.com Homepage, Procurement and Supply Chain, SaaS, PaaS, IaaS and BPaaS

This announcement has been extremely well received within the Procurian organization. The global recognition and support structure that Accenture provides will provide a fantastic platform to achieve the scale and growth potential this market space offers. Looking forward to an exciting future.

@Procurian Employee: kudos for not revealing your identity 🙂

[…] Horses for Sources Predicting and postulating potential procurement provider positioning post … […]

Procurian, great company that just enjoyed a tremendous growth spurt over the past 5 years. Problem being, it hit a critical mass and began to bleed backlog revenue like the Sh#*t through a goose. It needed a big brother to swoop in, save the day, before the wheels really came off. Good time to sell. Kudos to the original founders on timing

[…] Circle and when combined they created a market leader by share and by innovation. When we first commented on the acquisition we expected several more would quickly follow especially for Genpact and Capgemini who needed to […]