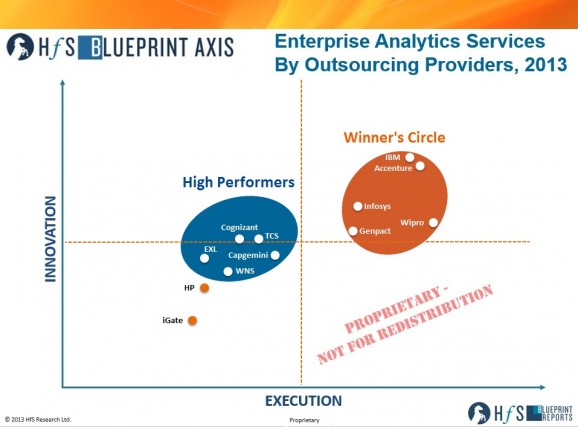

And finally one of the most complex Blueprints is finally final, where we researched across the services lines to ascertain which outsourcing service providers are delivering the goods for enterprise analytics services. Here’s a sneak look at the Axis:

Still preserving her sanity after collecting over 1000 data-points from 250 live multi-process enterprise analytics contracts, and conducting an exhaustive series of interviews with enterprise users of analytics services, we caught up with report author, analyst Reetika Joshi, to get a little more color into the analytics services environment and discover what she learned from the 2013 Blueprint process:

Reetika, is analytics really such a big deal for services, or just a lot of puff and bluster?

It’s a pretty big deal! Service providers are betting big on growing out their analytics capabilities in the next two years – and with good reason. I see analytics as a transformative force for an industry that’s undergoing an identity crisis. In ways, analytics is already helping IT and Business Services providers bridge the gap between being ‘vendors’ and being ‘partners’, offering ‘mess for less’ vs. smart, efficient business operations and most importantly, driving the conversation towards outcomes. Buy side organizations are leveraging these providers’ analytics expertise in many ways – improving reporting and efficiency improvements for business processes, getting help on overall information strategy, legacy BI frameworks and increasingly, advanced analytics initiatives around core business areas. Analytics is helping providers collaborate with their clients on solving industry-specific challenges and creating opportunities to improve core business areas including customer, finance, operations and risk – and that’s big business.

What stood out during the Blueprint analysis? Which industries / company sizes are have the greater analytics needs?

From a service area perspective, analytics data preparation and management and routine reporting remain critical services today. However, we see a growing number of engagements that include advanced analytics, predictive modeling, ongoing analytics support, and analytics consulting.

Industry verticals that have had greater data availability have naturally adopted analytics faster, across multiple business areas. These include banking and financial services, insurance, retail and consumer goods. As a result, analytics engagement maturity with service providers is also higher for companies in these verticals. They’ve developed confidence in their partnerships and are on the lookout for more complex analytics opportunities… leveraging emerging technologies (e.g. social media monitoring) or applicability in core areas (e.g. underwriting analytics). Companies in verticals that have comparatively recently had data availability (such as healthcare) are looking to providers to show them cross-industry learnings and opportunities for analytics interventions.

How did we assess analytics innovation and execution performance for providers? What did we look for?

Talking to buyers, they are most concerned about the quality of analytics talent working for them, industry expertise (particularly during strategy sessions and solution design), and flexibility in their analytics engagements. With this background, we applied our Blueprint methodology to evaluate innovation and execution for providers. With execution, we looked for solid delivery capabilities across the analytics value chain, analytics-specific geographical footprint and scale, experience delivering industry or horizontal-specific analytics solutions, flexibility to meet different client needs and the quality of customer relationships. For innovation, we looked for the completeness of vision of the end to end process lifecycle (from analytics road mapping to implementation and decision making), completeness of vision of industry-specific solutions (including talent and technology investments) and the ability to leverage external value drivers, including the other ‘SMAC’ components social, mobility and cloud.

I wanted to stress that the analytics services market is still nascent with many of the service provider models still emerging. As this is our first Blueprint in this space, we wanted to highlight the market leaders that have developed full service analytics capabilities, demonstrating scale and service depth across the analytics value chain. We evaluate services up and down the analytics value chain, including certain processes that aren’t ‘analytics’ per se, but are essential for analytics success, such as analytics data preparation and management. Our analysis reveals no true market ‘laggards’ for analytics, as we see expertise for one or more service categories from many providers.

We saw some surprises with the Winners Circle and High Performers – can you talk a bit about which providers have excelled versus those which could perform better further down the road?

Genpact, Infosys and Wipro are in the Winner’s Circle as they have significant scale in analytics, have demonstrated execution capability across service areas, and have very responsive account management teams. They have made great strides in vertical specializations and industry-unique analytics offerings and bring emerging technologies to clients. Along with these strengths, IBM and Accenture also have extensive experience in consulting, and have applied their expertise to help clients chart their analytics and data road maps and strategy. This makes their end-to-end vision for analytics compelling (I don’t even need to mention IBM’s $16B+ analytics acquisitions!) TCS and Capgemini have built strong offerings to help companies manage their requirements for ongoing reporting and insights. TCS especially excelled in the BFS analytics area. Cognizant, WNS, and EXL bring domain-specific innovations, having built strong industry-specific analytics capabilities especially in the high-end analytics modeling service area. I expect them to perform better in the next couple years as they are aggressively expanding these capabilities.

Overall, what would your recommendations be to both buyers and providers looking at enterprise analytics services in today’s environment?

- Talent will ultimately be the key to differentiation. The most satisfied buyers in our research spoke to the high quality of analytics talent they accessed through their providers. Buyers must look beyond fancy toolkits to the actual resources allotted to deriving insights from them. Onshore support, business context, and prior industry experience will make all the difference between good and great analytics providers in the near future.

- Leveraging emerging technologies will pay off. Buyers are looking externally for expertise in new technologies for analytics. Providers that invest in integrating services with new technologies will earn thought leadership. Opportunities include modern data mining, data visualization, industry-unique predictive modeling tools, mobile dashboarding, and strategies for leveraging big data.

- Leading with business perspective will drive value chain adoption. The bulk of work outsourced in this space continues to be in the realm of data preparedness and routine reporting. For advanced analytics and decision support to proliferate, the conversations must shift from the CIO’s office to business leaders, from costs to business outcomes. Winning providers will encourage brainstorming sessions and regular senior leadership and SME interactions with clients to drive high value creation. The majority of buyers still seek help with more foundational areas, but the scope for high-value analytics will continue to expand as operating models mature.

- Service providers must bring cross-industry lessons to succeed. Buyers look for analytics expertise from providers that have prior experience and increasingly industry vertical experience. Providers are accordingly developing CoEs and aligning solution sets by verticals. Our conversations with buyers reveal that they are now also looking to providers to bring best-of-breed innovations from across industries that may have shared applicability. We see functional areas as equally important service areas for analytics, and foresee innovative analytics implementations through cross-industrial partnerships.

The 2013 Blueprint Report for Enterprise Analytics Services can be accessed by HfS premium subscribers by clicking here.

Posted in : Business Process Outsourcing (BPO), HfS Blueprint Results, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Security and Risk, smac-and-big-data, Sourcing Best Practises, Talent in Sourcing

[…] And finally one of the most complex Blueprints is finally final, where we researched across the services lines to ascertain which outsourcing service providers are delivering the goods for enterprise analytics services… […]

very insightful, great job HFS team!

Good insights. The recommendations are very much correct and will be the differentating factors

[…] over the last 5 years. It also topped the service provider market for innovation in the recent HfS analytics blueprint assessment. However, many of these analytics deals grow incrementally from relationships where there is deep […]

[…] over the last 5 years. It also topped the service provider market for innovation in the recent HfS analytics blueprint assessment. However, many of these analytics deals grow incrementally from relationships where there is […]

[…] The 2013 Enterprise Analytics Services Blueprint is announced: Accenture, Genpact, IBM, Infosys and … – Analytics is helping providers collaborate with their clients on solving industry-specific challenges and creating opportunities to improve core business areas including customer, finance … especially excelled in the BFS analytics area. […]