When God invented broad-scale multi-process outsourcing for the back office in the 1990’s, a big chunk of the Global 2000 leapt up screaming “Please take our HR! Please fix it – Oh and save us 20% off the bottom-line while you’re at it”.

Lo and behold, by 2006, more than 300 major enterprises had already outsourced a proper bundle of core HR process to providers brave enough to take it all on – and try to make a profit in the process. Typically, these deals were payroll, benefits admin and a plethora of HR administrivia… all lumped together within an HR call center, with an employee portal veneer as a band-aid attempting to mask whatever assortment of manual non-standard processes, custom made spaghetti-code and dysfunctional on-premise technologies that came with the package.

In short, how can you outsource a people, process and technology nightmare and expect someone to replicate it and run it for less? Not only that, when the function being outsourced screams for the hills to resist this corporate colonoscopy with a stubbornness not seen since Custer’s Last Stand, it’s gonna go south… and fast.

Hence, it was hardly a surprise when Hewitt (pre-Aon) got skewered by its purchase of Exult, while Convergys almost died of HR-poisoning before offloading its HRO beast business to NGA. And we bet you’ve all long forgotten the aborted attempts of benefits specialists Fidelity and Mercer, which got the hell out of Dodge at the first sight of a “ring-fenced contract”. Meanwhile, the likes of perennial outsourcers HP (EDS), Accenture, IBM and Xerox (ACS) quickly got queasy with that they saw, opting to hang around on the off-chance something tasty came along, without sinking vast wads of cash into a function that was simply horrible to outsource.

So, what’s happened to multi-process HRO in today’s slightly-smarter BPO world? Who survived the early HRO ordeal to develop solutions that are profitable and functioning? And how have the Indian providers fared, with their own flavor of operational discipline?

So without further ado, let’s ask HfS’ lead analyst for HR and talent research and report author, Christa Degnan Manning, what in the world is happening in the HRO universe after conducting the most comprehensive study of multi-process HR providers and buyers to-date…

Christa – before we even get into the details of this Blueprint Report, the first thing that jumps out is the fact that the provider performance is a tad “mediocre”. What’s going on here?

It’s simple really – the employee experience still sucks! Given the significant dynamics of the changing global workforce and workplace, HfS has seen an opportunity to revisit this space and to redefine it from the consumer of services point of view – the employee. Too often in the quest for administrative cost savings and automation in the enterprise, the worker has been left out of the equation and HfS research shows this has had a significant impact on employee engagement, productivity, and retention.

So what is this report all about? Why is this the first Blueprint we are doing in HR?

The genesis of this study – taking this research job at HfS really – was that the typical state of employee support services today in large and small companies alike is abysmal. I have experienced it first hand, my friends have, even people at some of the large vendors we cover admit they feel similar frustrations as a worker – too many different self-service apps, help-desk service tickets, call center numbers, IVR (interactive voice response) rat holes – it is not a joke that the biggest advancement in HR for most firms is single sign on.

I make the analogy in the report that if the typical corporate HR service portfolio today was a retailer, it would be a dead-end discount strip mall with confusing, competing storefronts short on staff where people dread going. Just as companies that outsourced key customer support functions purely for cost reasons have learned from the error of their ways, I think the best businesses are going to realize that the employee experience is just as important as the customer experience. Maybe even more so, because the employee ultimately affects the customer experience.

So what we wanted to do was redefine “multi-process HRO” – a meaningless term really – in terms of workforce support services and what the worker wants. From the workforce research we have done, we know that people today want to be doing meaningful work, collaborating with colleagues, and rewarded for their best effforts – so we have reframed the consumption of services from a linear “hire to retire” model – (seriously, who knows anyone who has been hired and retired from the same firm these days? Except IBM?) To a more non-linear, day to day work day experience of the employee: What am I doing? Why am I doing it? Which gets to the whole area around rewards, remuneration, and recognition – what is my basic motivation for working here?

We think this sets the foundation for HR service delivery, starting with the most fundamental stuff, payroll, benefits, which absolutely require a consistent set of core data and have to be gotten right or all the talk of talent management, career development, and employee engagement is pointless. But we also included other monetary and non-monetary rewards such as tuition assistance, social media recognition, and even incentive travel as pure compensation budgets are strapped or capped and companies need to look at new ways to motivate workers.

So what did we find?

In 2014 multi-process HRO (excluding recruitment and learning outsourcing) will hit $36 billion, growing at a 5% clip and expected to grow closer to 6% for the next 4 years. I’d say this market is virtually untapped, though, when you consider the upside from truly transforming into workforce enablement services, which also takes into account collaboration, mobility, and performance management areas.

But, for now, to some extent we are using binoculars to look in a rear view mirror. While HfS research has shown that enterprises want to see more innovation and execution excellence from outsourcing providers across the board, this multi-tower HRO market today is largely a reflection of cost-cutting deals cut five to ten years ago.

That being said, given the competitive workforce and workplace dynamics today, companies that want to differentiate themselves can no longer accept simply not screwing up paying workers – they need to embrace new ways of engaging and empowering them to get back to the real business of serving the customer. The HRO service providers that have recognized this are the actors that dominate the stage and are in the prime position to take on more higher value BPO work around workforce analytics, planning, sourcing, and development over time as well.

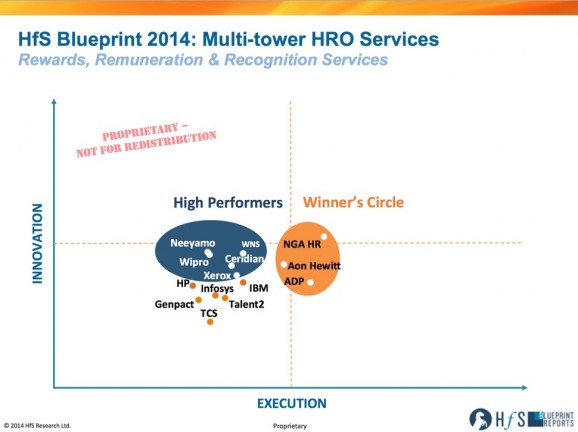

Who is in the Winner’s Circle and High Performers categories and Why?

HRO specialists dominated, but the upstart competition is fierce and hungry. Amongst the top performers, the companies that have been doing payroll and benefits as their core businesses were recognized (ADP, Aon Hewitt, Ceridian) as well as those that have particular discipline in HR outsourcing (NGA HR, Neeyamo, Xerox).

Winner’s Circle:

- NGA HR — proactive, flexible, global, partnership culture

- Aon Hewitt — total benefits approach, consulting capabilities for communications and change

- ADP — payroll prowess, mobility innovation, solid execution

However, several traditional and niche Indian-headquartered services firms, such as Wipro, Neeyamo and WNS, are aggressively investing and targeting workforce services as their next growth platform and counting on their traditional strengths of cost-efficiency, process excellence, and continuous improvement to win business and expand footprint with major enterprises worldwide. Buyers are taking notice and will definitely put these players in the mix to put pressure on their incumbents as many early HRO deals come up for renewal.

Of note, some of the High Performers have virtually no market share, but you know what? Neither did Google or Zappos or Netflix or any disruptive player in any market. In fact, whole books like the Innovator’s Dilemma have been written that in order to be bold and actually disrupt a market you have to come from the outside and start fresh with a whole new take. They are coming from related disciplines like ITO which in many cases is a workforce support service in and of itself. So I’d say we are at an inflection point in the industry. What used to be known as multi-process HRO, is now workforce services, and a different set of rules for success are being written.

What about some of the earlier leaders like HP, Xerox and IBM? Are they still in the game, or just seeing out their contracts?

Early pioneers/players HP, Xerox, and IBM all suffered in general from the fact their customers are reaping the seeds sown of first generation outsourcing based on labor arbitrage and cost reduction. While they can speak to a refreshed employee experience vision and offering set, by and large it remains to be seen if they can make the transition.

What about the role of technology here? What did you find from that perspective?

Good question. Many say the early mega multi-tower HRO deals went wrong because the systems were not in place to make the engagements scale effectively and I think the industry has learned its lesson. While there are still plenty of deals where the enterprise retains responsibility for the core HRIS (human resources information system), a number of vendors are now including technology, notably SaaS applications such as Dayforce, Ramco, and Workday as key enablers of the deals. However, these personnel data systems only go so far, and the leading HRO players have invested in their own technology wrappers and enablers such as portals and multi-channel communications platforms to provide a more streamlined and seamless user experience.

Software as a service is a real game changer though. The popularity of SaaS has helped HRO mature as companies learn to accept technology as an enabler of value in outsourcing as well as standardization. SaaS is also key to the market as companies consider giving additional work to incumbent information technology (IT) service providers they have good relationships with — they already know their industries and businesses. Providers doing SaaS implementations, collaboration, mobility, and analytics support are in prime position to extend these into workforce productivity services more broadly, particularly if they have global and on/nearshore footprints for contact center support.

So what are the key take aways?

There can’t be better business processes suited for outsourcing than payroll and benefits administration, but everyone has to take a more strategic view of it, enterprises understanding what motivates their workforces and the providers leading the way on the “how” which is serving the employee, not HR or procurement ends of themselves. A lot of HR and even HRO folks seem to be beaten down that HRO can never really come together to delight workers, but the people that believe in the employee experience and are energized to deliver good service – because at the end of the day HR is a service – are the ones that will be differentiated in their roles and their firms in the marketplace.

In the meantime, we offer the following advice:

End-to-end doesn’t exist. When one assesses the global breadth and depth of capabilities across the employee’s experience of pay, benefits, and other rewards from HRO vendors today, there is a wide range of support offerings. In speaking with vendors, it seems models often opportunistically developed to meet individual client’s needs so they don’t match the same footprint or needs of another consistently worldwide just yet. So companies should consider the areas where they have the biggest pain points or opportunities for improvement and evaluate vendors current and future product strategy against their own workforce objectives and reward maturity.

Look under the covers. More than one vendor indicated it is the subcontracted provider of another vendor in certain areas, despite that vendor selling a global solution. In HfS’s mind, this is acceptable if not inevitable, as long as the prime HRO providers are ultimately accountable for total global outcomes.

People help people. Despite or perhaps because of the advances in technology and the systems integration role that HRO providers are playing, buyers expressed particular appreciation for the staff of the HRO partner – both account management and operational teams – for making the difference in vendor performance. Buyers acknowledged that everything can not be seamless and integrated but the HRO providers that are responsive and accountable when exceptions arise or things go wrong are the ones that earned the highest marks.

The best is still not great. While the Blueprint methodology identifies the best players in the “Winners’ Circle” and those following as “High Performers,” even these players did not score high marks consistently across the board nor across all reference customers. Also of note, while the buyers of HRO services often praised their provider, there was frequent acknowledgement that the employee consumers of the services would not likely score the vendor as highly. This reflects the shift going on in the BPO marketplace to get beyond adequate in general and we predict the bar will be raised on service providers to meet consumer-grade retail shopping expectations of service across HRO.

Thanks, Christa, for an excellent synopsis of the new Blueprint.

HfS subscribers can click here to download their copy of the 2014 Multi-tower HR Outsourcing Blueprint Report

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Global Business Services, HfS Blueprint Results, HfSResearch.com Homepage, HR Outsourcing, HR Strategy, Sourcing Best Practises, Talent in Sourcing

[…] Three make Winner's Circle for Multi-tower HR Outsourcing: NGA, Aon Hewitt … From the workforce research we have done, we know that people today want to be doing meaningful work, collaborating with colleagues, and rewarded for their best effforts – so we have reframed the consumption of services from a linear “hire to retire … Read more on Horses for Sources […]

[…] HfS announces the first Blueprint Report in HR Outsourcing, with NGA, Aon Hewitt and ADP making the Winner's Circle […]

[…] When God invented broad-scale multi-process outsourcing for the back office in the 1990′s, a big chunk of the Global 2000 leapt up screaming “Please take our HR! Please fix it – Oh and save us Read full article […]

[…] day basis, and recognize and reward them in more meaningful ways. The first Blueprint we did was on Rewards, Remuneration and Recognition services, earlier in 2014 which took a new look at global payroll, benefits, and employee contact […]