As we digest the incredible dialog from the HfS Cambridge University blueprint summit this week, the overwhelming mood from enterprises is one of frustration to get beyond this tactical status quo of legacy operations, in which so many find themselves wedged.

And most services providers aren’t going to come to the table with the technology and talent until their customers clearly dictate and demand what they need to cross this chasm. And those providers which simply do not have the Digital capabilities their clients demand to address these gaps, run the risk of being relegated to the class of legacy staff augmentation provider that performs only the low-value grunt work, or ditched from many client provider rosters altogether. And this is already happening with some ambitious determined clients.

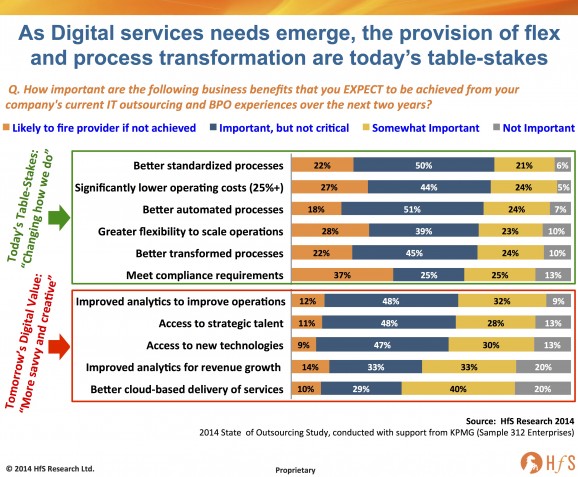

When we surveyed 312 enterprise buyers on their two-year expectations from their current outsourcing relationships, it becomes abundantly clear that those desired business outcomes from yesterday’s outsourcing era have quickly become today’s table-stakes:

Clients are rapidly losing patience with services providers that aren’t working proactively with them to provide more value than the basic terms of the original contract. I feel like we’ve had this conversation before, but this time many clients are doing a lot more than having a quiet moan that they aren’t really getting value beyond very basic service provision. This time, many are actively looking to fire their provider if they cannot get past operational teething issues and actively begin the process of transforming the way they do things. In so many instances, clients are beginning to doubt their current provider actually has the skills or acumen that they were promised during the early courting days prior to contract signing. In today’s climate, close to a quarter of clients will actively seek to eject their current provider if they have not effectively helped them standardize, automate and transform their processes within the next two years. This is no longer about achieving significant cost reduction targets and getting basic tactical operations functional – it is about moving clients into a future state that is much more effective than the current one.

The focus on Digital outcomes has dramatically emerged, with many clients increasingly no longer viewing tactical success as their end-game. Whereas, in years gone by, the focus was slowly shifting from cost reduction to better global scale (see our 2010 study), the onus on clients to move the conversation to one of better analytical capability, more savvy and creative support talent, access to better tools and tech, has leapt onto the table: these are the new stakes. While most providers will not get fired today for Digital failure in the short-term, it is already very clear that an increasing majority of enterprise clients expect their providers to bring these skills to the table. 60% already see operational analytics as very important as an outsourcing outcome, and a similar majority are already expecting their providers to pony up savvy talent and better tech within two years.

The Bottom-line: Innovation is now defined and most clients know what they need. Providers have to step up if they want permission to play in the next phase of this industry

Remember all those fantastical debates about “What is innovation and how can I get some?” Well, the answers are now unraveling and it’s becoming clear how both buyers and providers can be successful in the future – and how they can also maintain the status quo and risk being relegated to the detritus of legacy operations. Clients no longer yearn for transformation of processes, reduced costs and flexibility of global scale – because that’s what most have already bought and paid-for. Hence, those not getting these outcomes today are not yearning, they are feeling duped and let down – and know they are failing and going down on their provider’s sinking ship.

The table-stakes of 2014 are now a must-have for clients which have their eyes firmly planted on what they need to achieve in the medium and long term. They want providers who know how to engage with them to help them get to the next level. However, too many of today’s providers have lost interest in their clients once they have reached an operational steady-state – and are constantly laser-focused on winning that next deal, as opposed to fixing their existing ones.

Until our industry takes the painful steps to fix the current legacy it has created, many will likely fail in creating a new era of Digital services. This means both clients and providers need to invest in the skills and tools they need – and recognize that failure to do so will likely result in their ultimate failure to drag themselves out of operational low-value purgatory. In addition, intermediaries and advisors need to stop forcing these deals to get done in three-week RFPs so they can walk away with their fees paid with little care for what that client and its provider really achieve down the road. We all need to focus on planning and investing in the long-term future and not solely on the quick wins staring us in the face near term.

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Digital Transformation, HfS Surveys: State of Outsourcing 2014, HfSResearch.com Homepage, HR Strategy, IT Outsourcing / IT Services, kpo-analytics, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, Sourcing Best Practises, sourcing-change, Talent in Sourcing, the-industry-speaks

Great insight and wonderfully written, Phil. Its clear the industry is maturing much quicker than many people expected – suppliers have been getting away with some very basic delivery of services and are now under a lot more scrutiny to deliver the value they promised when they signed the contract. I think we will see a fast rationalization of the winners and losers in the services business with the onset of digital,

Alan Walsh

Phil,

I completely agree with this data. Buyers are much more prepared to take action to get the value they were promised- which is why some are taking drastic measures to re-bid their work,

Heather

Your line about providers being laser-focused on winning their next deal is spot-on. Too many of them are ignoring their existing business which could fall away if they do not help them get get beyond basic labor arbitrage. Complacency is a huge problem in this business today.

Eric

Phil,

The changing pace of customer expectations seems to be accelerating. It only seems like yesterday that clients were content once an existing operations was running on time and budget. Now customer want so much more – analytics, transformation, technology, cloud etc. It’s going to be hard for many providers to keep up with the increased demand,

Bill

[…] The new table-stakes: Fixing the Analog Present for a Digital Future Clients are rapidly losing patience with services providers that aren't working proactively with them to provide more value than the basic terms of the original contract. I feel like we've had this conversation before, but this time many clients are … Read more on Horses for Sources […]

Interesting data, Phil. Rather than asking what clients expect, we should ask them what they really WANT.

@Alan: We’ll see the smart Tier 1’s develop offerings that cater for clients pushing for more disruptive solutions and an influx of niche players and Tier 3’s with no legacy clients, which target clients purely with Digital-esque solutions that incorporate analytics, mobile, social elements with process automation capabilities. I fear for some Tier 2’s which are stuck with legacy clients and lack the funds or will to invest in next-generation offerings that go beyond labor provision,

PF

@Heather: Indeed. Some clients are taking a major financial hit to make the switch too…

PF

@Eric – many clients last week cited the fact their provider had become too “comfortable”. That’s a problem…

PF

@Bill – also hard for providers to offer solutions that are counter to their current revenue model (more tech, less labor).

PF

@Thomas – we ask them how important outcomes are to their business in our recent GBS survey – see here. Desires for outcomes only get stronger (not different) as operations mature: cost, data, talent, control, collaboration and innovation….

PF

Excellent insights, applicable to the public sector as well as private. Thanks for sharing openly your knowledge Phil.

[…] succeeding and failing – and how can both buyers and providers work towards collectively realistic and meaningful expectations. What needs to change with the way buyers operate, providers deliver, and advisors advise? Click […]

[…] succeeding and failing – and how can both buyers and providers work towards collectively realistic and meaningful expectations. What needs to change with the way buyers operate, providers deliver, and advisors advise? Click […]

[…] digitizing the way we’ve always done things, it’s about digitizing the way things need to be done to be more competitive and effective in the future. Digital is also about progressing our talent to […]

[…] of averageness, will be the losers in this new era of services. The table-stakes of services have shifted rapidly in just a few short years, where ambitious clients are now expecting providers to come to the table […]

[…] chart, from an HFS report[4], clearly presents the growing importance of transformational improvement to […]

[…] chart, from an HFS report, clearly presents the growing importance of transformational improvement to […]

[…] chart, from an HFS report[4], clearly presents the growing importance of transformational improvement to […]

[…] chart, from an HFS report, clearly presents the growing importance of transformational improvement to […]

[…] chart, from an HFS report, clearly presents the growing importance of transformational improvement to […]

[…] chart, from an HFS report, clearly presents the growing importance of transformational improvement to […]

[…] (Cross-posted @ Horses for Sources) […]