The world of work has become a very, very different place in just a few short years. Today’s workers need to adapt, develop and promote their skills to make themselves attractive in today’s Digital economy – and savvy employers need to try harder than ever to ensure they are finding staff who can do more than simply transact – they increasingly want people who can think, create, analyze, collaborate and sell; people who are embracing today’s technology to create value to their organization. Ambitious employers want talented workers which can align themselves with where they want their businesses to go, not with the legacy environment from where they are trying to evolve.

So what better strategy to adopt than hire a service provider to take care of this talent headache for you? Surely it’s time to explain to your HR department that fishing through resumes on LinkedIn is unlikely going to net you the best people? Surely it’s time to partner with a recruiting expert that can quickly understand your business, the talent you need, and how to go out into today’s people marketplace to find it?

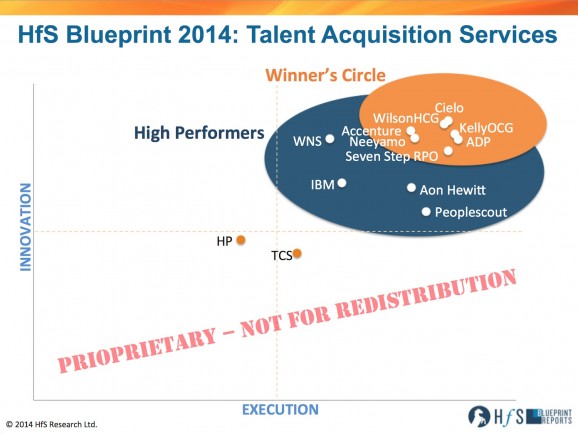

So we tasked our global workforce and talent expert, Christa Degnan Manning, to assess those services providers helping organizations fill their open positions. The Talent Acquisition Services Blueprint is the second in a series of HfS Workforce Support Services Blueprints reexamining and redefining how organizations are creating operating models and solution portfolios to support today’s workforces. And here is how the providers today shake out, after Christa had put them through the HfS Blueprint mincer:

So Christa, what exactly are Talent Acquisition Service providers and how do they fit in with the overall research you are doing?

A key principle of my Workforce Support Services research approach is that the traditional HR “hire to retire” process-driven solution approach is completely obsolete in the modern workplace. We can see from the Power to the People research few people are actually planning to stay with their current firm until retirement, and they are struggling to focus on the right work to stay engaged and be productive.

So companies have to think differently about how they identify the right workers, support them in their collaboration and development on a day to day basis, and recognize and reward them in more meaningful ways. The first Blueprint we did was on Rewards, Remuneration and Recognition services, earlier in 2014 which took a new look at global payroll, benefits, and employee contact center providers and how they are moving away from simply processing paychecks to really help keep workers focused on work and appreciative of the support they get from the business.

Then given what HfS saw in terms of both the disengagement in the workplace and this massive workforce exodus upon us, I targeted Talent Acquisition Services next. HfS defines Talent Acquisition Service providers as those third-party firms that support companies in the strategy, sourcing, and engagement programs and processes required to attract and activate workers as businesses desire today.

Talent Acquisition Service delivery is evolving from the traditional recruitment process outsourcing (RPO) and contingent or contract work managed service providers (MSP) worlds as companies seek access to more flexible labor pools and talent sourcing and management support models as well.

We know that work is getting done today across an extended enterprise of traditional workers, contract laborers, and third-party service partners, so our new Blueprint explicitly assessed if third-party service firms could support clients across types of labor: staff (traditional full- or part-time employees) and contract (contingent labor).

And to achieve business outcomes of quality of hire, faster time to productivity, or better engagement and retention, these services providers are having to go deeper into traditional talent management areas like workforce strategy and planning, helping clients answer: what is the employer value proposition to potential workers? What makes them productive or retained over time?

This gets into more qualitative issues than simply sourcing and placing workers, so we also looked at capabilities amongst the service providers in terms of how they could support talent strategy and engagement as well.

And what are the important service provider capabilities companies are looking for today?

First, it’s talent. Recruiters who know how to find passive candidates, assessment experts that understand people and organizational psychology, creative communicators who can help identify and amplify a company’s unique employer brand and value proposition, and analytical and proactive account staff that can look across a client’s business as well as network and share with their peers to identify opportunities or challenges and offer suggestions for solutions.

Given the dynamics of hard to find skills and the geographic differences in labor markets, companies are looking for specific talent acquisition focus and sophisticated expertise, including in new technologies.

Second it’s the availability of the technology solutions themselves, particularly social media sourcing and passive talent community development, because firms are no longer simply filling reqs, but supporting the complexities of matching the right people to the right roles at the right time, which is much less of a transaction and more of an on-going supply chain and relationship development set of issues.

Of note, this has meant some early multi-HRO players with administrative transactional models are opting out or just catching up in the Talent Acquisition Services marketplace, while others have successfully doubled down and are being recognized for developing talent strategies and changing outcomes, not just doing support tasks.

Yet new entrants are also emerging specifically to deliver technology-enabled talent acquisition services that support overall talent management objectives like engagement or retention. They don’t even use the term “outsourcing” to describe themselves really, it’s just good service delivery.

So which providers are leading this emerging new Talent Acquisition Services market space?

Companies in the Winners’ Circle were those that have aggressively targeted providing progressive service delivery as we define it and incorporating the use of new sourcing methods and technologies, specifically:

- Accenture – seen as a strategic client advisor with technology, global footprint, and C-level trust

- Cielo (formerly Pinstripe Ochre House) – a growing global player rising to the top of the talent services “sky”

- KellyOCG – leading the industry in adapting acquisition to supply dynamics and methods

- TheRightThing! – an early leader in progressive outsourcing being absorbed by ADP

- Seven Step – savvy strategy and seamless services stalwart poised for greater success

- Neeyamo – a complete human resources outsourcer featuring flexibility and focus

- WilsonHCG – a tech-enabled talent acquisition specialist going global

High Performers were AonHewitt, IBM, Peoplescout, and WNS who are clearly going after talent acquisition clients, but have room to develop either in terms of broader strategy and engagement capabilities recognized and used by clients, or across traditional staff and contract labor support, or both.

Of note, we also include 8 short profiles of companies in the traditional recruiting or staffing agency space that appear to be targeting this market, but shy away from official analyst RFIs. These service providers will have to embrace new scrutiny though as they ultimately compete against the breadth of technology-enabled business service providers investing in the talent space.

And what are some of the key take-aways of the study, Christa?

In light of all of the changes and challenges in the modern workforce and workplace, I see talent acquisition today as the tip of the spear to broader workforce transformation. To deliver value beyond cost take out, Talent Acquisition Service providers are now being tasked with partnering with clients to acknowledge – and in many cases address – fundamental workplace and workforce issues beyond simply posting requisitions and screening workers. They are having to deal with the issues that impact quality of hire and company performance through approaches such as culture match and soft skills assessments which completely changes the way a company sees and values talent in many cases.

From competitive pay data benchmarks and labor mapping to identifying employee engagement elements and career development initiatives, the bar is being raised against which the service providers are assessed for their ability to impact the quality of hire. But this also means buyers have to change how they operate and treat people in order to secure and retain the best workers today.

Many of the enterprises I spoke with acknowledged that they are relying on their services partners to both strategically guide as well as tactically support them in on-going talent transformation efforts and it’s going to be a long but ultimately necessary journey – and one they have to take with a third-party to be able to achieve results because they simply don’t have the resources or expertise themselves today.

An interesting aspect of the research you did was to document how fat Talent Acquisition Service providers are along the path to “progressive service delivery”, which we often talk about, can you expand more on this concept?

With the expectations being raised with regard to the business transformation impact from talent acquisition services, more and more buyers say they are collaboratively partnering with service providers who they see as an extension of their own organizations, in many case completely transparent to their candidates and employees.

In this way, talent acquisition buyer/service provider partnerships are exhibiting the acknowledgement and commitment to Workforce Support Service orientations, where they actively work to culturally match the staff on their accounts with the client, find ways to motivate and reward extended teams based on a joint mission to drive business outcomes, and to provide ways they can connect across their organizations and regions as an extended enterprise.

In delivering their services to the marketplace as third-parties specifically sensitive and focused on people and talent, I’d say Talent Acquisition Service providers are leading examples of the characteristics of successful enterprise workforce extension. The service providers in our Winners Circle were recognized for developing an on-going partnership mentality to focus on outcomes not just the “hire” but in securing a well-matched and engaged worker with a positive experience in the business.

Also of note, while a number of long-term traditional outsourcing type contracts were analyzed as a part of this research report, more and more companies are seeking to buy Talent Acquisition Services in shorter contract durations, including project-initiated ways, with an eye to expanding to broader on-going service delivery as their needs dictate – and scaling down when necessary. This was clearly a flexibility that the Winners Circle service providers embraced. They are also very open to having discussions with their partners to add additional capabilities and technologies that ultimately involve new business and pricing models.

With regards to technology, Christa, you’ve called it out as a contentious issue, can you elaborate?

As most early RPO and MSP engagements were tactical and administrative in nature, buyers of services often asked their service providers to use the buyer’s internal enterprise applicant tracking systems (ATS) and contract labor vendor management systems (VMS); others were open to suggestions from their providers or to interact with their proprietary systems if they had to.

Today the market is still split on technologies, some not expecting much beyond what they offer to their service provider staff, others who want new technologies and innovations brought to them part and parcel of the contract. Notably some of the latter are very vocal about who should pay for access to technologies – they say if the service provider team can and should be able to benefit from tech across their customer bases, there should not be separate and equal fees as if they were buying the technologies themselves.

With an accelerating pace of SaaS-based innovation across HR and talent, the use of technology will be a deciding factor in the future success of talent acquisition broadly. I predict the Talent Acquisition Services space will lead a transformation in the SaaS marketplace itself, where SaaS firms negotiate wholesale or volume agreements with service providers so they can help implement and consume the technologies, wrapped by their staff and proprietary service delivery capabilities, and analyze the data that is thrown off and provide advice.

I believe that is the way that enterprises will and should expect to engage with operational capability service providers – not as separate SaaS or outsourcing in and of themselves – in the future. Don’t you?

Christa, thanks for taking the time to share your new research… we look forward to more of your continued coverage of the global workforce in the coming months. HfS readers can click here to view highlights of all our current 15 HfS Blueprint reports.

HfS subscribers click here to access the new report, “Talent Acquisition Service Providers – Partners on the Path to Total Talent Management”

Posted in : Business Process Outsourcing (BPO), HfS Blueprint Results, HfSResearch.com Homepage, HR Outsourcing, HR Strategy, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises, sourcing-change, Talent in Sourcing

[…] HfS’ workforce and talent analyst, Christa Degnan Manning, shared her insights with her new Talent Acquisition Services Blueprint, which brought forward many of the issues surrounding talent retention and creating a work […]

[…] The 2014 Talent Acquisition Services Blueprint: Which providers are delivering in today’s Digi… […]

[…] The 2014 Talent Acquisition Services … – The 2014 Talent Acquisition Services Blueprint: Defining and Sourcing the Talent you need in today’s Digitally-challenged marketplace […]