The world of enterprise mobility continues to unravel at a breathless clip, with a host of application, infrastructure and niche specialist service providers claiming to deliver (much) more than a bunch of Blackberries, mobile servers and basic help-desk support to enterprise clients.

Enterprise mobility has quickly propelled into the corporate mainstream, with almost every consumer-facing, employee-engaging, supply-chain-enabling process requiring critical mobility interfaces and integration points to avoid becoming obsolete. And with so many processes now going completely native to the mobile world, from membership programs for healthcare insurance schemes, through to governance productivity tools, through to tax management applications etc., the mobility prowess, from a business transformation aspect, is the Holy Grail the winning service providers are seeking to stay ahead of this fast-commoditizing digital marketplace.

So, without further ado, let’s focus on how the 2015 enterprise mobility services environment is shaping up with HfS’ digital research guru, Ned May’s, new release of the 2015 Enterprise Mobility Blueprint:

Hi Ned, what has changed in the enterprise services mobility market over the last year?

I am pretty amazed at how fast the market has shifted. In the year that’s passed since my last Blueprint, we now see a majority of enterprises undertaking efforts to integrate their mobility portfolios deeper into legacy systems. Few enterprises were at that stage a year ago when it was the build out of point solutions that dominated the activity sourced from service providers in mobility. Even just a year ago, efforts to integrate these apps were largely aspirational but now it is a major area of effort between service providers and enterprise clients.

This increase in market demand for more sophisticated solutions translated into impressive results for some leading service providers. For example, IBM’s mobility revenues grew over 300% in 2014 to reach $2 billion. That makes Mobility a significant contributor to IBM’s services revenue. In short, the opportunity has arrived and I expect the current level of activity around mobility to continue. “Digital” may have become the de facto term service providers use to describe their practices around enabling technologies but when you peel this activity back a layer you quickly find the bulk of activity has a significant mobile component. Whether an enterprise is looking to drive increased efficiency across a current processes, open up new customer channels, or developing a new business model, more often than not today it involves some type of mobile device.

And how did the Blueprint analysis turn out?

The big surprise this year was how well the largest service providers faired. In a rapidly shifting market you might expect smaller and perhaps nimbler service providers to excel but what we saw was the largest service providers fared the best. Topping this off was the success of IBM which I already mentioned grew over 300% in 2014 and that is off a base of $650 million in revenue the year before. That grow would be impossible off the back of new Apps alone. It is a result of the big push from clients for deeper enterprise integration.

At the same time, we saw a second tier of service providers emerge in an area of what I’d call focused scale. These were all large enough to drive efficiency across their delivery models while addressing the myriad of related technologies but not necessarily in the same breadth of industry or end-to-end fashion as the largest service providers. Arguably, these second tier service providers are in great positions position for 2015 as the maturing market looks for further specialization.

So what are your key takeaways from this study and what should we be watching for in the next few years?

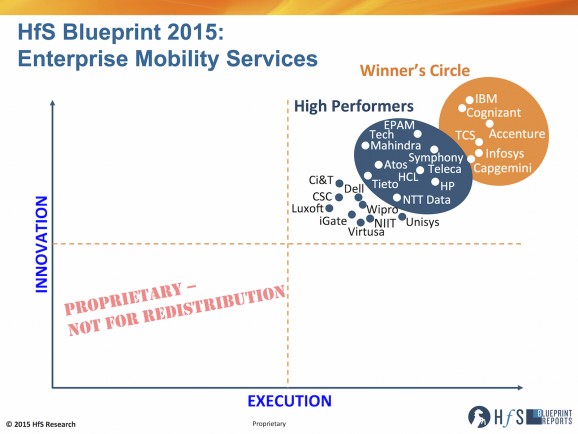

One of the most significant takeaways our analysis yielded was a realization that the relative positioning of service providers has become greatly compressed. Every service provider analyzed offers significant capabilities across our criteria for both execution and innovation.

Our Winner’s Circle of Service Providers included: Accenture, Capgemini, Cognizant, IBM, Infosys and TCS. Our High Performers were: Atos, EPAM, HCL, HP, NTT Data, Symphony Teleca, Tech Mahindra and Tieto.

Yet, the differences are getting more difficult to discern and that makes for a buyer’s market at least for the next year or so while integration remains king. We expect this to change in 2016 as a few service providers begin to demonstrate the unique advantages they gained by extending their definition of mobility to include the Internet of Things. Until this occurs the market will be led by those service providers who can drive the greatest efficiency around areas like running App Factories, providing Testing-as-a-Service and embedding security across every interface.

Another takeaway is that we don’t expect to see a great deal of commercial demand for mobility-led transformation in 2015. When enterprises tapped their IT departments to rationalize the disparate mobile efforts underway, they inadvertently put the brakes on innovation. IT organizations are notoriously conservative and as they work to integrate the mess, they are reluctant to let go of any recently reclaimed control. This means we don’t expect to see significant activity around transformation just yet and that could be a lost opportunity as enterprises spend perhaps too much energy on neatly tying together loose ends rather than embracing these new mobile technologies as a way to drive fundamental change. The only caveat here would be for those enterprises that have a strong Chief Digital Officer in place. Where this type of leader exists we expect to see some healthy conflict between running processes more smoothly and running processes in new ways. But again, the bulk of activity in 2015 will be around developing apps more efficiently and integrating them into existing systems.

HfS readers can click here to view highlights of all our 22 HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report, “HfS Blueprint Report 2015: Enterprise Mobility Services“

Posted in : Business Process Outsourcing (BPO), Cloud Computing, CRM and Marketing, Digital Transformation, Global Business Services, HfS Blueprint Results, HfSResearch.com Homepage, IT Outsourcing / IT Services, Security and Risk, smac-and-big-data, Social Networking, Sourcing Best Practises, The As-a-Service Economy, The Internet of Things

[…] been named to the ‘Winner’s Circle’ by analyst firm HfS Research in its “2015 Enterprise Mobility Services Blueprint Report,” authored by Ned May, Senior Vice President Research, Digital Transformation Services & […]

[…] been named to the ‘Winner’s Circle’ by analyst firm HfS Research in its “2015 Enterprise Mobility Services Blueprint Report,” authored by Ned May, Senior Vice President Research, Digital Transformation Services & […]

[…] been named to the ‘Winner’s Circle’ by analyst firm HfS Research in its “2015 Enterprise Mobility Services Blueprint Report,” authored by Ned May, Senior Vice President Research, Digital Transformation Services […]

Thanks for yet another look in how Mobile has been evolving inside big enterprises and how service providers are adapting to opportunities. When we last spoke, (for your previous report) I was in my transition from head of mobile at CI&T to head of products. I have, however, followed the development of our mobile and digital offering throughout. I challenge your classification of CI&T and your definition of “High Performer”. For me a high performer in the mobile space isn’t only the one capable of understanding all the idiosyncrasies of the big enterprises and have a “platform mindset”, but also the ones highly capable of building incredible mobile experiences. Experiences consumers of all kinds expect because they love the way they use their phones and other devices. At CI&T we have built a solid and successful User Experience practice inside our Digital Studio. One that will certainly challenge even the companies you register as ‘Winners’.

Putting myself in the shoes of a potential buyer, I am not sure your report will be able to help them connect their needs to what the service providers can offer. You are basically saying what the industry have always preached “go with the big ones and you will be safer” when we know as a fact that this is far from the winning approach for companies looking for true agility. Best results in the realm of digital transformation, come from nimbler companies like CI&T, Luxoft and EPAM (from your list.)

Mars – Thanks for your comments.

I don’t dispute CI&T has done some very innovative work in Mobile and as you can see neither did the collective voice of our research pool as your company rated above even several High Performers in this regard. However, the market for enterprise mobility moved fast in 2014 and buyers are now more often than not looking for robust and rapidly scalable development efforts as they moved from Mobile First to something akin to Mobile Everything.

So while there are some laggard industries with participants still hoping to gain some sort of competitive advantage from a unique and differentiated mobile experience, the majority of enterprises we engage with are looking to industrialize their mobile efforts. Perhaps this doesn’t come across as clearly as it should in this blog post but the full report explores it in more depth. Again, I’d agree with your take that CI&T and some others are all doing great work in the mobility market, it is just that we are seeing a shift in the needs of most enterprises to a place where the strengths of the larger global players are serving them better at this time,

Ned

[…] real process acumen and technology enablement skills – at scale – in areas such as mobility, analytics and social media/collaboration. The ability to design […]

[…] together real process acumen and technology enablement skills – at scale – in areas such as mobility, analytics and social media/collaboration. The ability to design “digitally-native” end-to-end […]

[…] The 2015 Enterprise Mobility Services Blueprint: IBM, Cognizant, Accenture, TCS, Infosys and Capgemi… – And with so many processes now going completely native to the mobile world, from membership programs for healthcare insurance schemes … stage a year ago when it was the build out of point solutions that dominated the activity sourced from service … […]