We’ve been talking about the great divide between consulting and outsourcing models for decades, but – finally – it’s time for the two to get much closer together as the forces of the As-a-Service Economy combine to weld the two models into a new services mongrel which combines simplicity, efficiency and capability for enterprises finally attempting to drag themselves away from their perpetual treadmill of obsolete technologies and valueless process flows.

We’ve been talking about the great divide between consulting and outsourcing models for decades, but – finally – it’s time for the two to get much closer together as the forces of the As-a-Service Economy combine to weld the two models into a new services mongrel which combines simplicity, efficiency and capability for enterprises finally attempting to drag themselves away from their perpetual treadmill of obsolete technologies and valueless process flows.

The whole premise behind As-a-Service is one of a fundamental cultural change with how enterprises approach their operations and partner more collaboratively with capable service providers to re-imagine their processes, based on defined business outcomes. Simply put, it’s a huge, huge challenge for most current services relationships to morph into anything closely resembling an As-a-Service model, with the current mindsets of most buyside and sellside delivery staff. Buyers need deep expertise to help them reorient their skills and capabilities – and their service providers need to make serious investments and sacrifices to help them, which give their accountants and shareholders hives.

Coupled with the troubles facing buyers and their service providers, is the abject failure of most of today’s sourcing consultants to do anything difference to reform their old way of doing things. Yes, it’s a Catch-22 of many service industry stakeholders not wanting to change their ways, but being forced to address these issues to remain relevant and – let’s face it, employed. In short, the pace at which the services economy is evolving will render many people unemployable in a few short years who fail to get ahead of this.

Just remember how foreign the concept of cloud computing was just five years’ ago… you think it’s going to take that long again for RPA to take hold, and significant advancements in artificial intelligence to reshape how enterprises run their operations? Think again, people; things simply have to change – and these market forces will make sure there will be winners, survivors and losers who will fizzle away into insignificance.

But the answers are staring us in the face – the future of services is a combination of the ability to create business value based on processes that are run efficiently, simplistically, and to common standards we find acceptable.

Consultants make a living demonstrating value in order to create demand to sell their capabilities. This is where too many service providers will terminally struggle

Clever consultants find problems, not just solve them. The only way to get buyers to do anything different is to convince them that hiring you will inspire them to make these changes. This is what able consultants do – they want to be billing themselves out 2,000 hours a year to their clients, so they are constantly looking to find problems, not merely make incremental improvements to existing processes that add minimal value.

BPOs need consulting skills – at scale – to succeed. I hate to say this, but you can’t achieve real success with the next wave of labor-lite solutions with a couple of smart visionary guys living on planes with their PPT mosaics. That may have worked for BPO rounds one and two, but this is round three and there needs to be lots more feet on the ground to be effective. Most of today’s BPOs are operating with very thin layers of consultants to front their client relationships. Simply put, they do not have enough to genuinely scale this beyond a few discreet engagements.

Clients will pay when they see the value in front of their faces. BPO grew up on the sale of immediate cost reduction – a unique value sale that created the industry we are in today. However, as the labor savings run out of room, the sale has to shift to one of future ROI and value – something, let’s face it, which is very challenging for our legacy service providers and advisors to succeed at and manage. However, clients frequently pay for skillful consultants who can come in and make a difference, who will find problems and sell their capabilities to solve them to their clients. The As-a-Service value proposition is really a combo of this consultative prowess and the efficiency and simplicity of effective BPO. So, the two need to be better conjoined to grant clients what they really need. (I stress the term need, as opposed to want, as many enterprises do not know what they need, so there isn’t too much to want until they have it spelled out in front of them…)

BPO delivery staff are simply not very “right-brained”. It’s just how the industry has evolved – lots of people who have a transactional mindset. They do what they are told, they follow a process… that’s nigh-on impossible to change. However, put BPO staff under the management of skilled consultants and this impossible mindset may just start to be molded.

Consultants will struggle without an As-a-Service delivery model behind them. While BPOs clearly need consultants, the same applies vice versa. Clients increasingly do not want to spend millions on custom engagements – the cash just isn’t there, like it used to be, to reconfigure their operations. However, they will buy managed services that are predictable and have a sustainable value proposition. I have used the term Expertise-as-a-Service for a while now, and it’s making increasing sense as the realities of the As-a-Service Economy continue to unravel.

There is no written curriculum for this industry to follow. Yup – we can rewrite the rule book, folks. We’re really venturing into unchartered waters, so what’s preventing this marriage of business models?

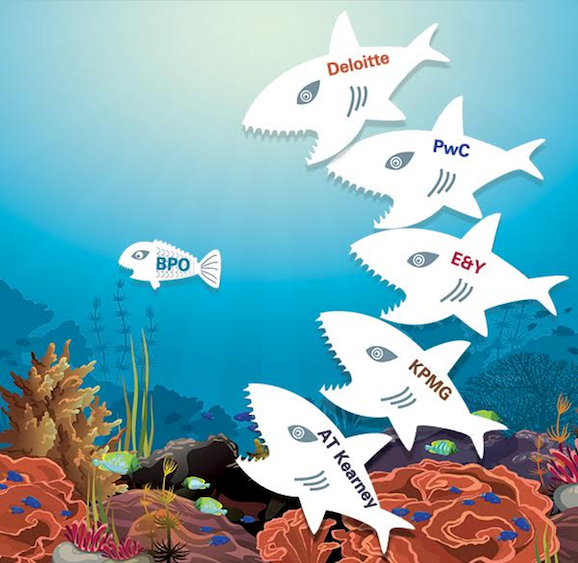

New market entities can chase after As-a-Service projects without the risk of self-cannibalization. This is significant. Let’s just assume, for example, Deloitte purchases an F&A BPO business and launches a spin-off As-a-Service provider business that doesn’t conflict with its audit business. This new entity can bid for brand new As-a-Service deals that incorporate the benefits of RPA, AI etc without any legacy revenue that will get eroded – it can pick off re-bids from legacy deals that have become stagnant, in addition to bidding for “virgin” As-a-Service deals from clients venturing into the model for the first time. Bottom-line – all new business is gravy.

As-a-Service demands the whole gamut of people-process-technology change. The pilgrimage to As-a-Service is all about simplification – people willing to offload the transactional work to focus on higher value talks; IT willing to write-off legacy applications and systems that may have absorbed millions of dollars to keep them functioning over the years; and processes that have become obsolete and need re-imagining to align with providing genuine value.

Clients need to trust providers to give up more… consultants are successful because they build trust. This is what consultants do – they invest in clients to trust them, as trust is all they really have. Service providers struggle to build trust because it’s all about the deal to them – once they have a contract, it’s about meeting the obligations, as opposed to really building that trust. It’s just the nature of the relationship.

The Bottom-line: Change is coming with the advent of As-a-Service, and it might not be quite what you expect

You only need to have a few conversations with key industry stakeholders to realize something isn’t quite right with the industry these days. Many buyers are in denial that they need to do anything different, despite all the disruptive technology emerging; most service providers recognize the disruption, but are more concerned with sounding impressive than actually delivering. Can we really progress in this era of denial and bullshit? Of course not…. we will see a few bold moves to get ahead of this market, and some may well come from this potential marriage of big consulting and big BPO.

Posted in : Business Process Outsourcing (BPO), HfSResearch.com Homepage, HR Strategy, IT Outsourcing / IT Services, kpo-analytics, Outsourcing Advisors, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, sourcing-change, Talent in Sourcing, The As-a-Service Economy

Phil,

You’ve hit on a very important topic here, and your rationale is excellent. The “Big 4” need to have more ongoing stickiness with clients as As-a-Service takes hold, while the BPOs will forever be struggling to deliver the innovation clients genuinely need to change the model,

Paul Beatty

Excellent insight. While you make a compelling argument, do the Deloittes and co really have As-a-Service capability? From my experience, the consultants are not wired in the way of managed services at all,

Gaurav

@Gaurav – The management consultants tend to be the most adept and building methodology and scaling it. Most may not be “ahead of the curve”, but when they see the curve and their clients realize they need the help, they tend to get their act together. I’ve been quite impressed with what I am seeing from the likes of KPMG and PwC in the areas of RPA exploration and advanced analysts, for example, and even some of the sourcing advisors, such as Alsbridge, are investing in RPA capability. On the ITO/BPO side, they’re all talking a big game with their consulting and Design Thinking prowess, and I can already see tensions developing between the advisors and providers when it comes to who’s controlling the client. This isn’t too dissimilar from the early 2000’s when KPMG span out OPI, Deloitte had a potential F&A business it sold to Convergys, and PwC sold it’s HRO business to Exult (AONHewitt). BPO originally was spawn from the big consultants, then many moved away from the model as early phase BPO was beset with nasty operational and margin issues. However, with the impending complexity of client needs, and the increasing competency of BPOs to deliver profitable transactional services at scale, I can see the value proposition of the two models beginning to fuse back together increasing. The stickiness of managed services combined with the consultative acumen of a global advisor with scale creates a pretty compelling proposition.

My prediction? The more the BPOs compete with the consultants, the more the consultants will realize they could have their lunch eaten, and are missing an opportunity. The realization that As-a-Service demands a combination of transactional capability at scale, combined with genuine business transformation – in a sustained ongoing model – makes the case for the full service As-a-Service provide who can engage, simplify and deliver for clients,

PF

Phil

One area where this blurring between consulting and BPO is really accelerating is in procurement. Later this week we will launch the HfS Blueprint on Procurement As-a-Service where we look at how these different delivery models and commercial structures have come together in the last several years and how this will be a continuing change in the years to come.

CS

Many of those pioneering deals of late 90s, went south for the early players (PWC, Accenture, IBM, Deloitte, Hewitt), which meant that these were sold off and/or contracts closed and divisions shrunk or became internal functions. Only Accenture and IBM, perhaps some others continued onwards (NGA, ADP, etc.) with the full service model (redesign/consult – outsource).

The next wave of players also burnt their fingers (Convergys sold off their HRO business to NGA, for example).

The big reason was obvious – these deals were unviable due to significant transition complexity of full functions, that meant that the financial construct of making some returns over ten years contract period was a pipe dream. The other reason was the inability of these consultants in establishing platforms and moving customers over to the ready to use service platform (not exactly SaaS). Building a SAP or Oracle/PS solution for each customer was a nightmare.

The Big 4 need to seriously consider the lessons from the past.

You articulate what I live on a daily basis. This is all a failure of imagination. The level of discourse between buyers and sellers is low. Buyers are looking for magic answers, and do not put the right people in roles to problem-find with their service partners. The RFP process is like The Bachelorette. Superficial conversations and interactions…and who will get the rose? Chances are whoever does eventually loses, as the relationship goes south. Buyers need to up their game and put imaginative, strategic leaders willing to see the future differently in roles working with providers – and providers need to be able not only to put together solutions on paper, but truly deliver them in a cost-effective way. The Big 4’s blended rates are non-competitive, and their offshore teams do not bring anything more to the table than pure BPO providers, though pure BPO providers often can’t put real solutions together that truly change the game. It is a broken model. Part of the problem is that buyers tend to have differing needs and/or significant investments in legacy infrastructure that they are overly attached to. Therefore, this is a disincentive to providers to invest for scale, as the reusability of a given service may be low given buyers’ differing requirements. Providers need to figure out how to lower the barrier to change to buyers, and take risk out of the process. They do not understand the psychology of the buyer. It is easier in the short run to avoid risk and live with something sub-optimal than to take risk on something that is future and uncertain. Providers need to remove this risk or assume it. Ultimately this is a challenge of putting the right people on both sides who are willing to creatively collaborate, and on the sell side to provide not just intellectual capital and roadmaps, but cost-effective end-to-end delivery. Your idea of the Big 4 joining forces with capable delivery arms makes a lot of sense. And the buyers need to step it up.

Phil, I agree to the view point in principle. What I also see is the blurring divide between the two and thus an obvious need to acquire each other’s skills, strategy, approach and game play. With more and clients insisting on end to end and a unified management of multiple providers, I see a greater convergence in the time to come.

Phil, you may have a point from the Big 4s perspective, but what about the Buyers? With 10 years in management consulting and 12 in BPOs, I can say this: Adding value to processes does not necessarily come out of blue sky thinking. There is science and logic to how processes operate and how they can be improved. With extreme cost pressures and survival at stake, buyers have opted for the easy path of outsourcing. Does that make sense from a business perspective for ALL processes? Are they losing out on the cash flow cycle even as they gain on cost per invoice?

I would go against the wind and suggest that the Big 4 should be talking to their clients on what they should be doing without jumping onto the outsourcing bandwagon and have that only as the last resort.

If providers have “not added value”, it is simply because they are not fools to destroy their own revenues (As any industrial engineer would say, the best process is the one that is not required to be performed). What makes us believe that the Big 4 would act any different if they were to also become BPO providers

Yep, it absolutely makes sense for these large consulting/advisory firms to acquire something down on the value chain, like a BPO/BPS services players.

Though Big4’s main portfolio of offerings has/will always remain/ed in Audit, Taxation & Assurance(ATA) services, but off late they have started venturing into core legal services, and a decent amount revenue has already been trickling from IT Advisory or Technology consulting too.

With the rise & voluminous demand of knowledge processing services like Analytics, robotics process automation (RPA), Process simplification/redesign and various outcomes of operational excellence has made BPO/BPS players a very strategic partner in clients end game to bring in more “customer centric” & Digital approach in the fast & ever changing uncertain future to improve their top line growth while maintaining bottom line without much pain.

There are very few players in market who have full scale, seamless, robust End2End offering (Strategy/Operations Consulting, IT Services & products, Infra, Digital offerings, BPO/BPS capabilities).

IBM, CapGemini, Atos falls within this category but clearly lacks the depth/width/scale in compare to Accenture.

Top Strategy firms(Mck, BCG, Bain, ADL,ATK PACG, RolandB etc)are very keen on maintaining their niche ( except for Analytics offerings, which anyway they are maintaining thru their various onshore/offshore & global in house centres(GIC’s) or thru various partnership with BPO/BPS players). So any possible acquisition can change some equation for strategy firms too.

On the other side, Large IT services players like TCS, Infy, Wipro, Cognizant, HCL, Mahindra Satyam, Dell/Perot, Xerox/ACS and other mid size players too off late have built-in significant BPO/BPS capabilities thru organic and inorganic approach. while their pursuit for going up on the value chain is still a long long way to go but due to their sheer size, the cash pile they are sitting on, rising market cap and their quest of remain nimble & relevant is helping them to acquire companies or products left & right or up & down on the value chain. This is happening irrespective of vertical, horizontal, geographies or future potential, be it analytics, products, Infra, robotics, digital, consulting or regulatory frameworks opportunities.

Most of BPO/BPS deals are large, multi year deals and runs into US$100+ in size. There is no doubt that for the vendors, it is not only good at cash & profit generation but also in padding up their margins thru various cross sell and up sell of offerings & services.

Lets try looking at things from Clients perspective. They are spending millions of $ just to manage their various multi vendor partners program (across consulting, audit/tax, IT,Infra and BPO) and managing communication, governance & discord between them is one of the biggest pain point.

The worst is at times to identify & understand where the buck stops and with which vendor.

I know clients who are managing more than 50+ vendors for these sort of activities and they are very keen or already doing vendor consolidation initiatives from 50 to say less than 20.

We are so concerned about seamless, consistent multi channel customer experience in B2C world, so why not in this kind of arrangement.

Imagine, the kind of value addition, cost savings and process redesign Big4 can offer when they will take over the Business As Usual (BAU) of F&A process or KYC or client on boarding etc for their clients. They can utilize this bottom up view/approach to revamp/simplify the entire organization holistically cause they already would have built “a top down view” in this case while doing Audit, Taxation & Assurances activities for the same client across their parent/subsidiary in the same or in other geography while they are well versed with the accounting standards, taxation practices and assurances norms & compliances.

The only down side, which I feel is it can make the survival of small and new BPO/BPS player very difficult.

Well, any such move by Big4’s to become full service As-a-Service provider is going to make regulators across various globe/countries very uncomfortable and any possible scenario like Enron, Lehman Bros etc will give them enough ammo to arm twist the players and create post “Andersen consulting” scenario over and again.

I am optimistic about the economic sense, operational feasibility and long term future of this sort of acquisition.

@Allison – that’s the most refreshingly honest diatribe I have read in a while! “Understanding the psychology of the buyer” is exactly right for any provider looking to move up the value pyramid, as opposed to down…

PF

@Raja – Big 4 are trained to find problems within their clients, while most BPO (and ITO) providers tend to just gear towards basic operational solutions to keep the wheels turning.

The only way these type of mergers would work is if we combine the best of both worlds into a single blended model – efficiency and capability at scale – and run at not-too-insane cost levels for clients to absorb,

PF

Brilliant piece. I’m going to print and keep it on my desk

Totally agree with Charles that this blurring is accelerated in Procurement space. But getting this integration working is easier said than done, even for big 4s.

Not beating my chest but Infosys made an early move when they acquired Portland Group in Australia more than three years ago. The learning from integrating Procurement consulting with outsourcing services has definitely added value in its experience.

Well said Allison, it definitely comes down (often) to these two –

– Provider’s affinity towards repeatable, scalable and reusable offerings; they do not really want to get into higher risk areas with uncertain outcomes as they lack the skills and it breaks the model,

which is at odds with

– Buyers that prefer to see lower risk and faster/clear benefit to up their game towards new offerings that challenge the legacy or redesign the processes towards a XaaS model – else they will use just lower cost services and standard offerings from providers.

So, this is the divide that sadly will not be crossed easily because consulting and problem solving require different skills and capabilities, so Yes it has been a broken model.

I have seen boutique professional services firms being able to get the right people to the table and help buyers navigate the journey, when it comes to looking at specific problem areas in processes/functions as well as in the implementation and operations.

Of course, the Big4 have their own repeatable capability, skills and the experiences to provide value in their context. For example – new GL/chart of accounts design or say new benefits design, or new transfer pricing processes or in compliance & more, but in the past they have not built larger offshore capability to successfully/consistently deliver the associated BPO services even if it is something they logically can influence better.

@Phil – so many good points here…and I have seen many real life experiences illustrating your points over the last two years in our marketing practice. In that area especially the conversation has to start with performance and economic gains, not cost savings. And you are right, a combination of skills (consulting, process, operations, and delivery) all need to come together to solve a single problem in a collective way.

One of area of particular note is what our marketing clients have said a couple of times about the right mix of teams. Our consulting teams excel at finding issues and identifying new opportunities. But when we then try to execute against those with consulting teams, clients haved pushed back: they want marketing and delivery teams in delivery roles, people who are trained to execute and get work done, not just continue to identify new opportunities or interview their team perpetually about process flows. In our world the mix of consulting and operations has been central to many of our best relationships.

Last part: where BPO teams will struggle is in how to manage the inherrent flexiblity that is behind the as-a-service model. Staffing large teams to do the same work day in and day out, especially in front office activities like procurement, marketing and customer service, is a thing of the past. As-a-service means on when I want it, off when I don’t. We’ll need to find staffing models that can accomodate that.

Any robust P2P SaaS platform will be comprehensive; be expert template driven; be transaction processing easy-to-use; be interactive between buyers and suppliers/sellers and their colleagues; be risk-fighting; be performance documented; be set-up for eSupervision and oversight; be integratable with finance packages and be deployable in 60 minutes or less with access to continuous real-time training. So how much external consulting effort will actually be required ?

Phil,

I know at least one of the big 4 and one Employee Benefit Consultancy who are awash with BPaaS, SaaS and Cloud projects. They probably just do not have the time (or incentive) to talk about it. While they build their experience and competitive advantage, the rest of the market will have a lot of catching up to do…if they are not building their own capabilities as well.

Girish, London

@girishmenezes

[…] on cue after we made the call is was high time for the leading consulting firms buy into BPO, KPMG makes its first major As-a-Service move, picking up Towers Watson’s HR Service […]

This is the best analysis ever written of the gap of where we (buyers/providers/consultants) are and where we want to be. But I disagree with the conclusion that the answer is big consulting entering the provider market. Here’s why:

Consultants are just as ill-equipped for tactical execution as providers are for strategic change and innovation. All the forward thinking in the world means nothing when the SLAs are red.

I think the answer comes primarily from the buy side: every engagement requires both a consultant and a provider. Buyers should set the tone so that it is a successful, partner-based triumvirate, not one where tensions exist for control of the relationship. Once that’s achieved, roles can be clearly defined and everyone can focus on what they are good at.

Both consultants and providers still do have to evolve their talent. I think this is in the form of “connectors”: providers have strategic, client-facing consultants who have the ability to align the provider’s solution to strategy set by consultants. Consultants will have execution experts who can govern the buyer/provider relationship based on both tactical measures (timeliness/accuracy) and strategy (are we scaling to the future on schedule?). And of course the buyer’s team must be sophisticated enough to ingest the value from both orgs.

These connectors are integrators of capability that form a complete ecosystem. In fact, they closely resemble the capability brokers that HfS has identified as the future of BPO.

@Phil – good comments. I just don’t see tomorrow’s enterprise wanting the burden of both consultant and service provider on their budget. The pie is shrinking for service delivery as more common standards and platforms are introduced, not growing. I would say that several of the service providers are already competing quite effectively with the consultants in areas like CFO services and digital transformation, analytics and RPA evaluations etc. The onus may be more on the consultants to protect their turf than anything else here,

PF