Prepare for a breakthrough year in the Generative Enterprise—powered by the potential of agentic AI to deliver end-to-end, self-improving, cross-silo processes to achieve business outcomes, the promise of deregulation, and greater access to the infrastructure of the Stargate program, and a new wave of LLM innovation exemplified by China’s DeepSeek.

There has never been more urgency to find the right services partner to match your firm’s ambitions. Our Generative Enterprise Services Horizons report 2025 identified several trends: how service providers are meeting enterprise needs, effectively training people, what enterprises need more of from their service partners, and what customers and partners have to say about their service experiences.

Who are the best Generative Enterprise service providers?

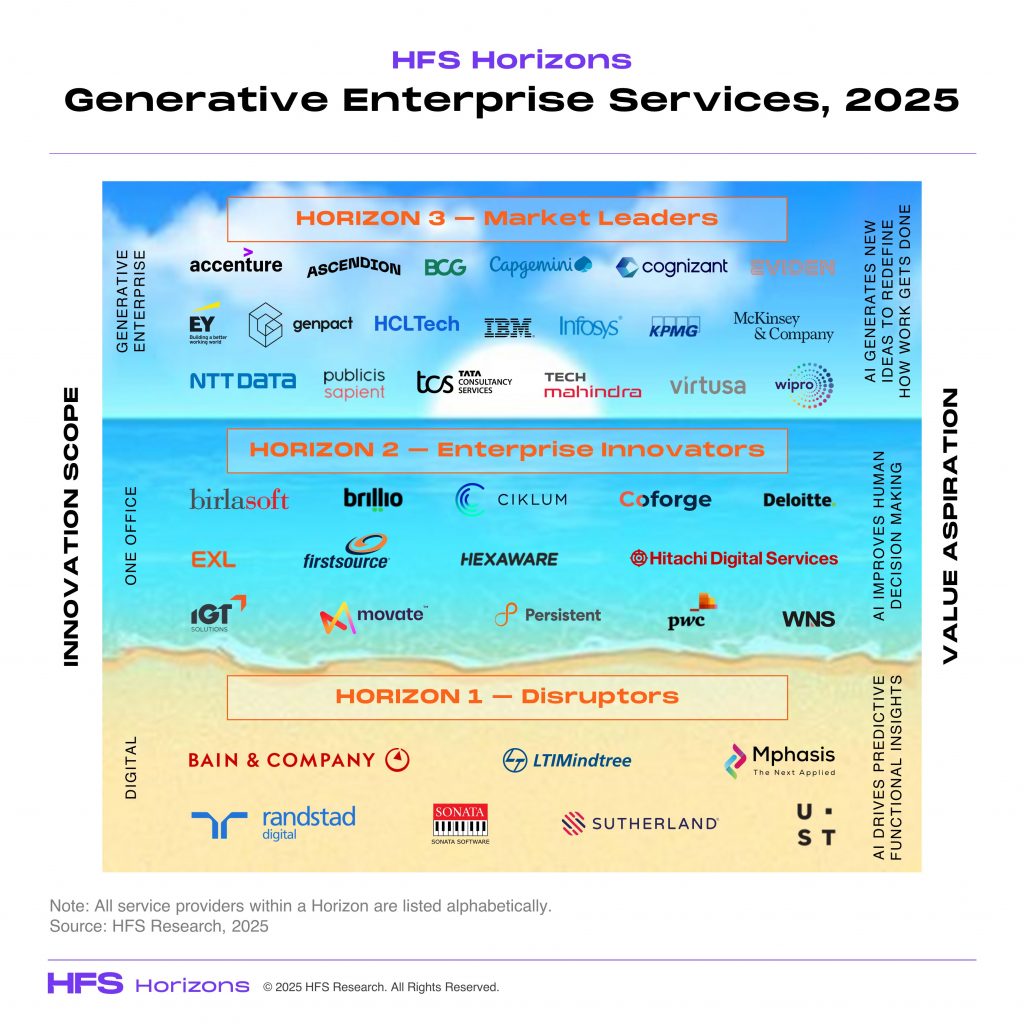

This report evaluates the capabilities of 40 service providers across the HFS Generative Enterprise value chain based on a range of dimensions to understand the why, what, how, and so what of their service offerings. It assesses how well service providers are helping their clients worldwide embrace innovation and realize value across three distinct Horizons: Horizon 1, optimization through functional digital change; Horizon 2, experience through end-to-end enterprise transformation; and Horizon 3, growth through ecosystem transformation (Exhibit 1).

Exhibit 1: The HFS Horizons model helps enterprises pick their service providers based on desired outcomes

We assessed these 40 service providers across their value propositions (the why), execution and innovation capabilities (the what), go-to-market strategy (the how), and market impact criteria (the so what). The Horizon 3 leaders (in alphabetical order) are Accenture, Ascendion, BCG, Capgemini, Cognizant, EY, Eviden, Genpact, HCLTech, IBM, Infosys, KPMG, McKinsey, NTT DATA, Publicis Sapient, TCS, Tech Mahindra, Virtusa, and Wipro. These service providers have demonstrated their ability to support various enterprises across the journey—from functional digital transformation through enterprise-wide modernization to creating new value through ecosystems. These leaders’ shared characteristics include deep expertise across the Generative Enterprise value chain; a full-service approach across consulting, IT, and operations; a strong focus on innovation, internally and externally with partners; co-innovation with clients and partners; and proven impact and outcomes with clients around the world.

A year is a (very) long time in the Generative Enterprise

When we published our 2023 Horizons report on Generative Enterprise Services (Q4, 2023), the gaps in capabilities and commitment across service providers were clearer. As we publish our 2025 Horizons report (Q1, 2025), those gaps have been compressed as demand for POCs and pilots has rocketed, and learning has been shared far and wide across the industry.

A year is a long time in the emergence of the Generative Enterprise. A year ago, agentic wasn’t even getting a name check. The LLM-capability arms race has continued with OpenAI, Meta, and Google all releasing multiple updates and new capabilities in text, image, and audio processing and taken a new twist with the arrival of DeepSeek. And now we have Trump’s Stargate for a boost to infrastructure, too.

Enterprises now demand business outcomes over experiments

Customers have shifted from initial experimentation to focusing GenAI’s capabilities on value outcomes. And that has led to the formalization of innovation pipelines in the enterprise – and integrated and repeatable offerings from service providers. But for all the formalization and standardization, there is no doubt we remain very early in this journey.

And while spending on GenAI is rising (HFS data suggests enterprise investment is rising by more than 25% on average into 2025), we start from a low base. We estimate enterprise spending on GenAI in 2024 accounted for less than 1% of global IT services spending. This is just one illustration of how far we still have to go.

Service providers are adding resources, expanding their ecosystems, and replacing labor with software

To help enterprises achieve the results they need with GenAI, services firms have continued to scale up their capabilities (by 250%) and extend their ecosystems.

Services firms are forming an increasing number of strategic alliances with large tech, cloud, and data companies such as NVIDIA, IBM, and Databricks to co-develop platforms, frameworks, and foundational capabilities; academic partners such as MIT and Stanford to further research the impact of GenAI; and niche AI players such as Hugging Face, Anthropic, Kore.ai, and Mistral AI to gain access to specialized AI capabilities such as fine-tuning.

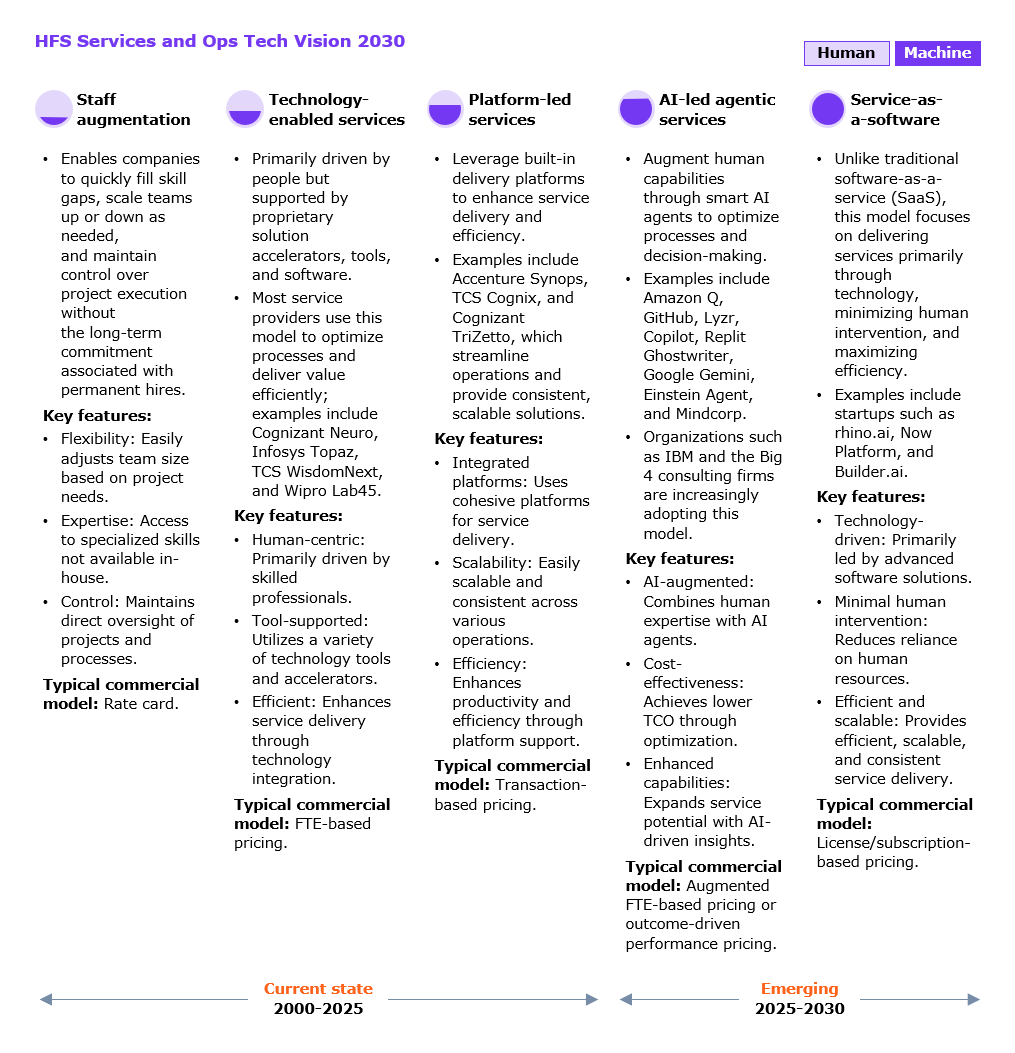

As services firms cozy up to tech providers, they become a little more like their tech partners—developing software solutions to replace work previously done by consultants. Examples such as SASVA from Persistent and Consulting Advantage from IBM illustrate the shift to the right HFS has been predicting in our Services-as-Software Vision 2030 (see Exhibit 2).

Exhibit 2: The lines between services and software are already blurring

Source: HFS Research, 2025

Enterprise-scale AI comes with new cost and control challenges

However, the examples of scaled success with GenAI remain scarce. Firms are stuck in a chicken-and-egg situation. Leaders must see ROI to take the leap and scale up their GenAI initiatives. Yet it is nearly impossible to prove value with just one or two POCs or pilots—such is the investment required to overcome data, privacy, and security concerns—let alone tackle the mountainous technical, skills, process, culture, and data debts accrued over decades.

The firms taking the leap to deliver at scale with GenAI soon hit cost and control issues—echoing the debates over the cloud. Many are learning that there is no single LLM solution to their enterprise needs—hence the rise of small language models (SLM) and models to support selection vs. accuracy, performance, and cost control, such as TCS’s WisdomNext platform.

DeepSeek is setting new expectations regarding training and related costs, and we expect market leaders to respond.

Data and technology debts restrict many firms to point solutions

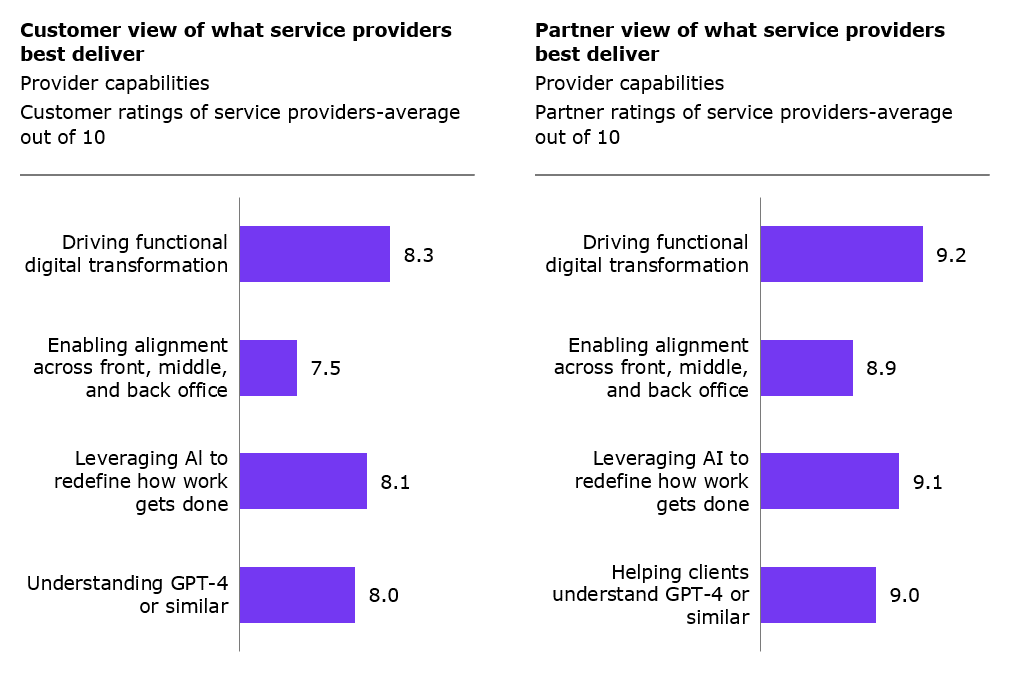

Enterprise customers and service providers’ partners rate service providers strongest when driving functional digital transformations (see Exhibit 3). These transformations are mostly point solutions that help clients achieve greater efficiency or improved CX or EX. However, these point solutions rarely deliver new sources of value or redefine how work gets done, making it difficult to meet ROI requirements.

Data and technology gaps must be filled to enable the disruptive potential of GenAI to extend end-to-end across processes. Currently, service providers are rated less effective at delivering the alignment across front, middle, and back offices that cross-silo processes demand (see Exhibit 3). Enterprises must be prepared to tackle their data silos.

Exhibit 3: Service providers are rated weakest on enabling cross-silo alignment

Sample: 75 GenAI partners and 71 customer references as part of the survey for the report.

Source: HFS Research, 2025

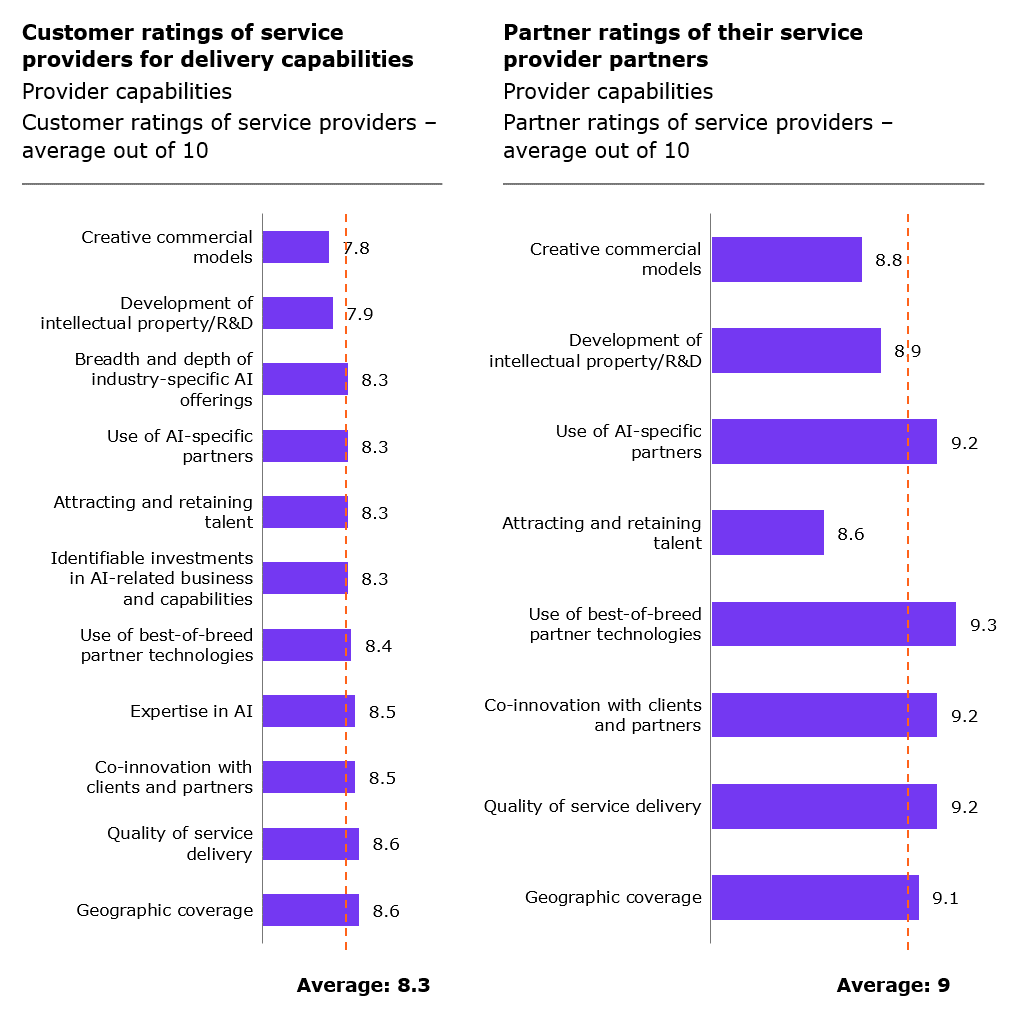

Talent supply is impacting the outcomes service providers can deliver for enterprises

Service providers have made huge investments in training employees on AI / GenAI; however, as seen in Exhibit 4, partners, in particular, have called out talent issues. The supply of AI / ML–experienced employees remains stretched, and a talent war is ongoing. Furthermore, customers and partners have indicated a greater need for creativity in commercial models and more GenAI-focused development of IP / R&D, including industry-specific AI offerings.

Exhibit 4: Service providers’ ability to attract the best AI talent is a concern for their partners and customers

Sample: 75 GenAI partners and 71 customer references as part of the survey for the report.

Source: HFS Research, 2025

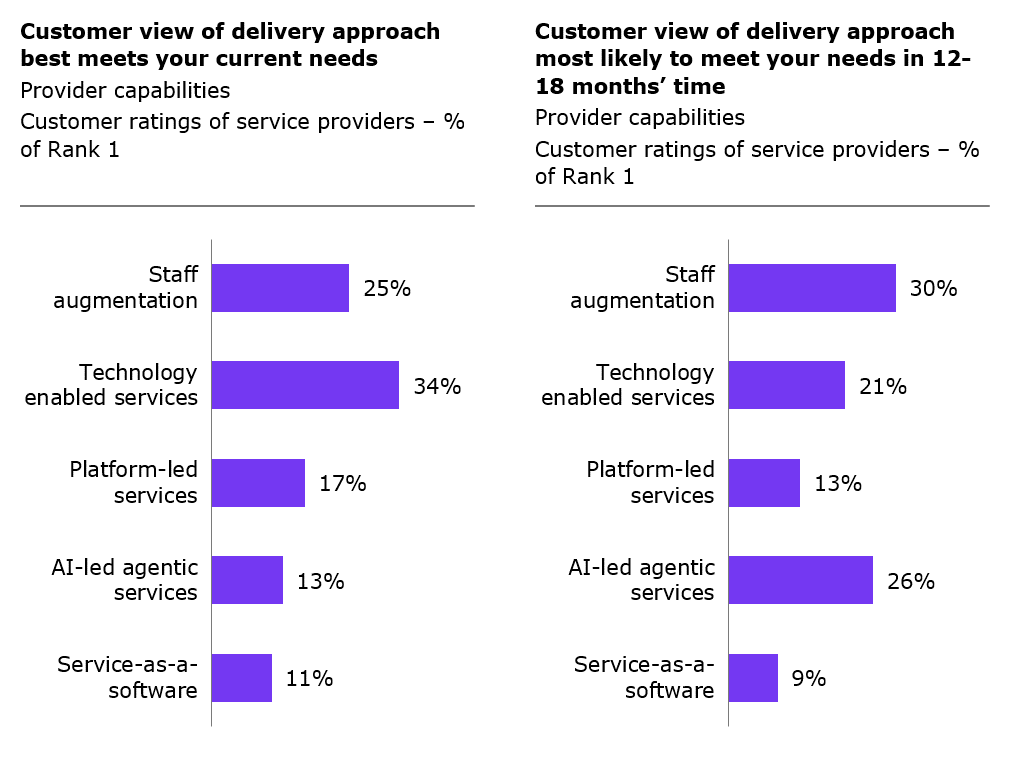

Agentic will be as essential as staff augmentation within 18 months

Currently, technology-enabled services and staff augmentation approaches are most in demand by customers. Within 18 months, customers’ service delivery preferences will shift, and autonomous AI-led agentic services handling complex decision-making tasks will be almost as important as staff augmentation (see Exhibit 5).

Services and software people come from different worlds and speak different languages, but they will need to come together—quickly—to align technology with business outcomes.

Exhibit 5: Customers expect agentic to play almost as large a part as staff augmentation within 18 months

Sample: 71 customer references as part of the survey for the report.

Sample: 71 customer references as part of the survey for the report.

Source: HFS Research, 2025

The Bottom Line: Choose a service provider that understands where your enterprise is on its Generative Enterprise journey—and is best positioned to meet you where you are.

It’s easy to be overwhelmed by possibility, excited by grand visions, and lose your way in pursuit of goals that are not within the current grasp of your organization.

When choosing your service provider partners, look for those who understand the business problems you face now. If your current problem is how to take the leap to scaling the impact of generative AI across the business, choose partners capable of supporting such ambition. But if you face more discrete and burning issues, be open to partners matching less ambitious outcomes. Solving the smaller problems is the route to preparing for the coming AI transformation.

Read our full Generative Enterprise Services Horizons Report 2025 – here to learn which service provider is best aligned with the results you want to achieve.

HFS subscribers can download the report here

Posted in : Agentic AI, Artificial Intelligence, ChatGPT, GenAI, Generative Enterprise, HFS Horizons, LLMs, The Generative Enterprise